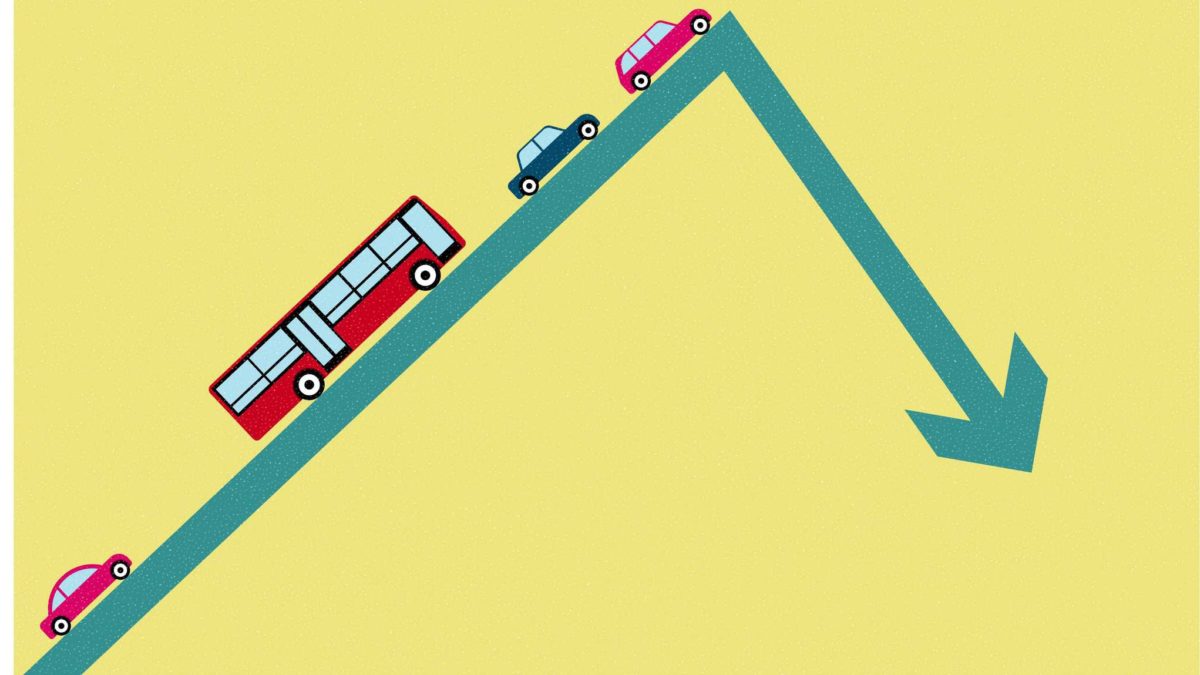

The Transurban Group (ASX: TCL) share price has fallen by around 6% since the start of 2022. But could the business soon see a recovery and drive higher?

For readers that don't know, Transurban is one of the world's largest toll-road operators. It designs, builds, owns and operates toll roads. Its asset base includes some of Australia's most well-known toll roads such as the Logan Motorway and AirportlinkM7 in Brisbane, CityLink and the West Gate Tunnel in Melbourne, and the Eastern Distributor and WestConnex in Sydney.

But it's becoming increasingly global. Transurban also has operations in Greater Washington, United States and Montreal, Canada.

What's happening to the Transurban share price?

There has been a lot of volatility on the ASX share market amid the Russian invasion of Ukraine as well as the prospect of higher interest rates to deal with strong inflation.

Why could interest rates matter to the valuation of a toll road business? Legendary investor Warren Buffett once said this about interest rates:

The value of every business, the value of a farm, the value of an apartment house, the value of any economic asset, is 100% sensitive to interest rates because all you are doing in investing is transferring some money to somebody now in exchange for what you expect the stream of money to be, to come in over a period of time, and the higher interest rates are the less that present value is going to be. So, every business by its nature…its intrinsic valuation is 100% sensitive to interest rates.

Traffic has been impacted by COVID-19, it's still lower than it was pre-COVID. However, traffic levels are recovering from the worst point seen in 2020.

FY22 half-year earnings wrap

The Transurban share price is slightly higher than when it reported in mid-February 2022.

With the impacts of lockdowns in places like Melbourne and Sydney, Transurban experienced a 4.8% decrease in average daily traffic across the portfolio in the FY22 half-year results. It also experienced a 0.2% decline of proportional toll revenue to $1.16 billion.

However, total proportional costs rose 10% to $417 million. This led to a 4% reduction of proportional earnings before interest, tax, depreciation and amortisation (EBITDA) to $805 million.

Free cash, including capital releases, fell 2% to $459 million.

Opportunity pipeline

Transurban says that it has a long-term investment horizon and a pipeline of opportunities in core markets which enables it to take a disciplined approach in growing the portfolio.

Some examples of those opportunities in the next five years include the Brisbane Logan Motor and Gateway Motor widening. In the US, there are opportunities like phase 1 of the Maryland Express Lanes project and "future traditional toll road and Express Lanes acquisition opportunities".

Is the Transurban share price compelling?

The listed investment company (LIC) Australian Foundation Investment Co. Ltd (ASX: AFI) thought that Transurban shares were attractive, with AFIC adding shares to its portfolio in the last few months.

AFIC says that Transurban has a good track record of capital allocation by management, driving "strong" long-term free cash flow growth. The LIC also said that Transurban has a solid balance sheet.

The investment company is expecting a FY23 recovery for Transurban. It noted that the cost blowout issue at the West Gate Tunnel project has now been resolved. AFIC likes the pipeline of potential opportunities, which it called attractive.

Another investment fund that likes Transurban is Magellan Infrastructure Fund (Currency Hedged) (ASX: MICH). On 28 February 2022, Transurban was one of the biggest ten positions in the portfolio. Toll roads made up 14% of the total portfolio.