The Qantas Airways Limited (ASX: QAN) share price has not performed too well during this Thursday's trading day. At the time of writing, Qantas shares are currently down a hefty 1.02% to $4.36 a share.

That puts the airline at a 3.44% loss over the past trading week. As well as a loss of 6.34% for the past month. The Qantas share price is also currently down 11.3% year to date in 2021 so far. But is still up 15.8% over the past 12 months.

So we don't have to dig too deep into Qantas' more recent woes. The prospects of a return to unfettered domestic interstate travel have been crushed by outbreaks of the COVID-19 Delta variant across the country. Hope is also fading for the dream of a reopening of our international borders, even with individual 'bubbles', anytime soon as well.

So during this difficult time for the Qantas share price, it might be useful to take a look at how Qantas shares have reacted to lockdowns in the past today. Let's dig in.

How does the Qantas share price perform during lockdowns?

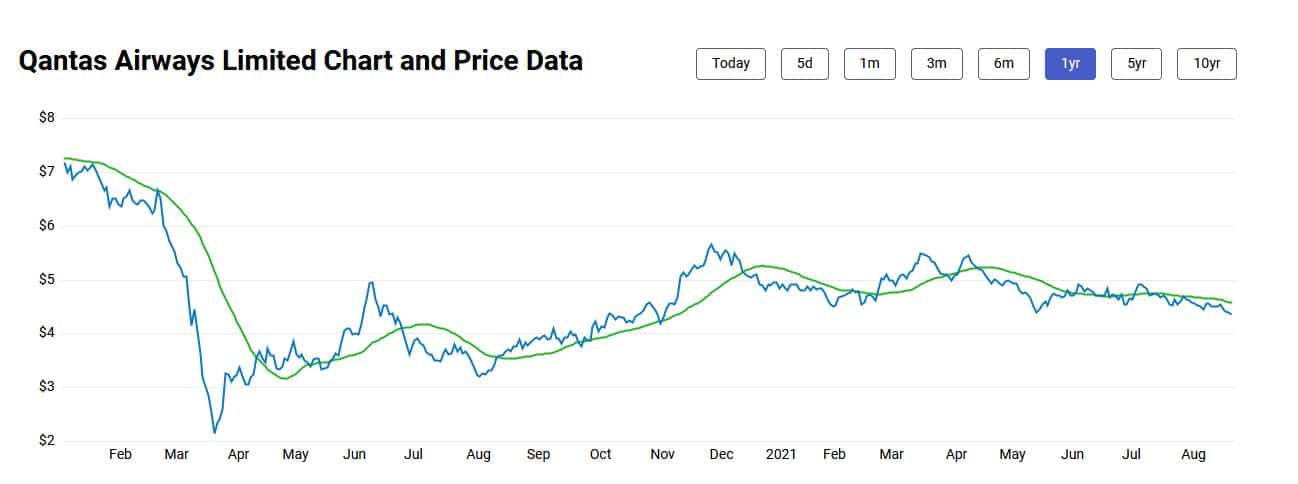

To start things off, here is a graph of the Qantas share price since the start of the 2020 calendar year (right before the onset of the pandemic):

As you can see, the largest and most dramatic move on this chart came during March and April 2020. That was when the entire ASX 200 experienced a nasty share market crash due to rapid lockdowns across the global economy. The ASX 200 peaked on February 21, 2020, and troughed on 23 March with a loss of roughly 34%. In contrast, the Qantas share price fell more than 65% over the same period.

During the period from August to October 2020, Melbourne was under strict lockdown, albeit while the rest of the country was enjoying a relatively high level of freedom. This lockdown in the country's second-largest state by population didn't seem to have much of an impact on the Qantas share price at the time. As you can see, Qantas shares actually appreciated quite a lot over this period.

But then we get to another outbreak – the December Sydney Northern Beaches scare of Christmas 2020. This outbreak began around mid-December 2020 and lasted until January. Over this difficult time, Qantas shares did take a hit, losing around 18.5% between 27 November 2020 and 29 January 2021.

What about Delta in 2021?

More recently, Qantas has also taken quite a substantial haircut in light of the multi-state Delta outbreak. Since the first 'week-long lockdown' for Sydneysiders that was announced on 25 June, Qantas shares have lost around 7.8% of their value. Ever since a prolonged lockdown became inevitable around the first few days of July, Qantas shares have lost more than 11%.

And that brings us to the present day. Qantas is clearly a company that is heavily impacted by COVID restrictions, and it's likely that we will continue to see the company under pressure until a national path out of this latest outbreak becomes clear.

At the current Qantas share price, the airline has a market capitalisation of $8.3 billion.