The Fortescue Metals Group Limited (ASX: FMG) share price staged an inspiring rally at the beginning of May as iron ore prices soared past US$200/tonne for the first time on record. Fortescue shares started the month at $22.48, before pushing to a 3-month high of $24.79 by 10 May. This was not too far off the company's record all-time high of $26.40 seen in January this year.

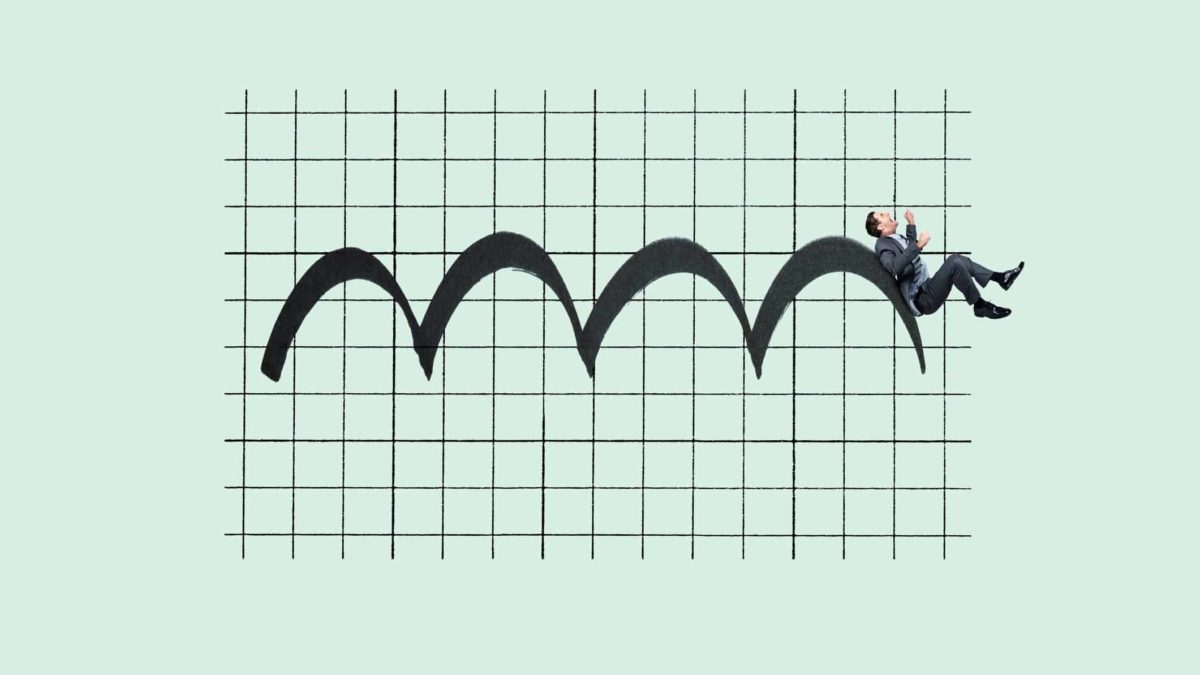

But the Fortescue share price quickly ran out of steam, giving back all its May gains to trade at $21.22 at Wednesday's close.

Why the pullback?

There has been a steady stream of negative news from Australia's largest iron ore customer, China, which could be one of the catalysts behind the recent weakness in the Fortescue share price.

Negative news broke out last week when China announced plans to increase domestic iron ore production in response to "unreasonable restrictions" on trade with Australia.

China also made moves to strengthen its domestic management of commodities to curb current "unreasonable" prices. This included investigations into malicious trading and suspicious pricing behaviours, adjustments on trade and stockpiling.

Chinese iron ore futures plunge

Last Monday, Yuan Talks reported that Chinese Government departments including the National Development and Reform Commission (NDRC), Ministry of Industry and Information Technology (MIIT), State Administration for Market Regulation (SAMR) and Chinese Securities Regulatory Commission (CSRC) "summoned major companies in iron ore, steel, copper, aluminium sectors, urging them to safeguard price stability in the commodities market".

This caused China's most-traded iron ore futures contracts in the Dalian Commodity Exchange to slump by more than 9% on the day to hit 1,016 yuan (A$203) per tonne. Iron by-products such as steel rebar and hot-rolled coil futures also slid by more than 6.5%.

Fortescue share price snapshot

Fortescue shares are not having the best time of it on the ASX in 2021 and are currently down by more than 9% year to date. Over the past year, however, the company's shares have surged by almost 54%.

Based on the current Fortescue share price, the company has a market capitalisation of around $67 billion.