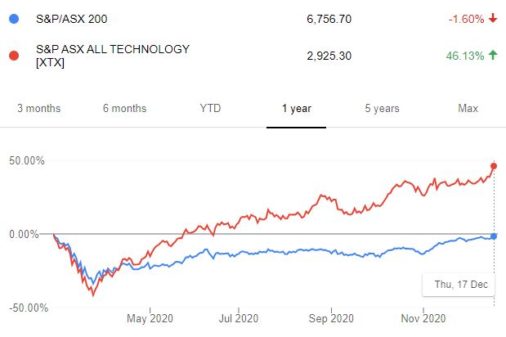

If there is one chart that shows just how crazy it was to be an investor in 2020 it is the one below; the S&P/ASX All Technology Index (INDEXASX: XTX):

To truly appreciate how magnificent this chart is let's keep in mind that the All Technology Index was only launched on 24 February this year.

The data can be back-dated further, which you can have a look at on the S&P Global website here, but it only officially started to track ASX technology-oriented companies in earnest this year.

Source: Google search. Google and the Google logo are registered trademarks of Google LLC, used with permission.

The index is designed to be a comprehensive measure of technology-oriented companies listed on the ASX, but its top five constituents have dominated with absolute blinding returns in 2020:

- Xero Limited (ASX: XRO) +89%

- Afterpay Ltd (ASX: APT) +313%

- SEEK Limited (ASX: SEK) +21%

- REA Group Limited (ASX: REA) +37%

ASX tech shares had the 'Fred Smith' of comebacks in 2020

There are two things in particular that make this chart a wonder. The first is the degree to which markets have moved in such a short period.

After plunging by more than one third in February and March, the All Technology Index has made a phenomenal comeback. The pivot from a decline of -42% to a gain of +46% (at 17 December, 2020) represents a trough-to-peak bounce of almost +145%. It's the Fred Smith of comebacks and something unthinkable just nine months ago.

The second remarkable point is the chasm that has formed between the tech index, which has exploded back, and the relatively ambling recovery of the broader S&P/ASX 200 Index (ASX: XJO).

It's hard to be derogatory about a 48% recovery for the ASX200 index from its low point on 23 March this year. But the tech index fell deeper, and has recovered far stronger, than the broader index as investors swooned over tech companies.

One standout ASX share still floating high

A true standout of the All Technology Index this year is Redbubble Ltd (ASX: RBL). Redbubble is a marketplace where people can sell prints of their art and graphic designs, but it's worthy of a special mention because of it's incredible 456% return in 2020.

In fact, the Redbubble share price fell as low as 40 cents per share in the COVID-19-led market meltdown, before roaring back with the growth in online shopping.

The company reported a juicy 36% increase in total revenue in the 2020 financial year and at least one analyst remains bullish on the company's prospects going forward.

What can we learn from this 2020 tech explosion?

There is a lot of takeaway from this. First, investing is hard. It is unpredictable and surprising.

That is why an important part of investing is putting money to work for long periods. Long periods of time means we remain invested for the good times and have the resilience to ride out the bad times.

Secondly, we should recognise that the global response to COVID-19 has seen the acceleration of a trend that has been growing for the last decade; software is still eating the world. Lower interest rates and a wave of stimulus has no-doubt added fuel to that fire.

As we head into 2021, a lot of investors will now be watching to see whether this fire is brought quietly under control as vaccines get rolled out. As the chart shows however, we should be prepared for anything.