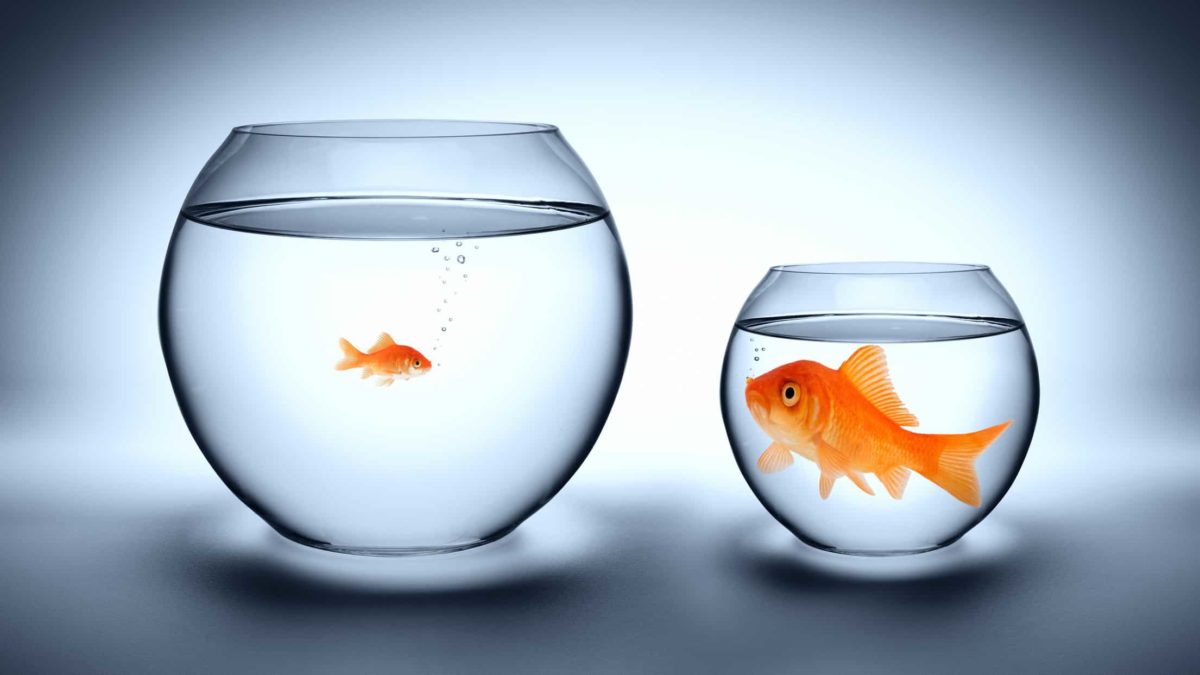

There is a belief among conservative retail investors that the largest publicly listed companies produce the most reliable returns.

They got to the top by ruling their market and have plenty of cash – so it makes sense, right? The cliché "too big to fail" comes to mind.

Paul Moore, chief investment officer at Sydney's PM Capital, has now shattered that theory.

Moore this week compared the top 10 biggest companies by market capitalisation at the turn of each decade since the 1980s. And he found the turnover in the club mind-blowing.

"It is rare for a stock to be in the top 10 at the start of one decade and to still be there at the start of the next decade ten years later," he said on Livewire.

"For example, in 1990 there were two survivors from the 1980 list, and in 2010 there were three survivors from the 2000 list. Since 1980 there have been no more than 30% 'survivor' stocks."

Top 10 shares by market capitalisation |

||||

|

1980 |

1990 |

2000 |

2010 |

2020 |

|

IBM (NYSE: IBM) |

Nippon Telegraph And Telephone Corp (TYO: 9432) |

Microsoft Corporation (NASDAQ: MSFT) |

Exxon Mobil |

Apple |

|

AT&T Inc (NYSE: T) |

Bank of Tokyo-Mitsubishi |

General Electric |

PetroChina Company Limited (SHA: 601857) |

Microsoft |

|

Exxon |

Industrial Bank of Japan |

NTT Docomo Inc (TYO: 9437) |

Apple Inc (NASDAQ: AAPL) |

Amazon.com Inc (NASDAQ: AMZN) |

|

Standard Oil |

Sumitomo Mitsui Financial Group Inc (TYO: 8316) |

Cisco Systems Inc (NASDAQ: CSCO) |

BHP Group Ltd (ASX: BHP) |

Facebook Inc (NASDAQ: FB) |

|

Schlumberger NV (NYSE: SLB) |

Toyota Motor Corp (TYO: 7203) |

Walmart Inc (NYSE: WMT) |

Microsoft |

Alphabet Inc Class C (NASDAQ: GOOG) |

|

Royal Dutch Shell Plc (AMS: RDSA) |

Fuji Bank |

Intel Corporation (NASDAQ: INTC) |

Industrial And Commercial Bank Of China (SHA: 601398) |

Alphabet Inc Class A (NASDAQ: GOOGL) |

|

Mobil |

Dai-Ichi Kangyo Bank |

Nippon Telegraph And Telephone Corp |

Petroleo Brasileiro SA Petrobras (BVMF: PETR4) |

Johnson & Johnson (NYSE: JNJ) |

|

Atlantic Richfield |

IBM |

Exxon Mobil Corporation (NYSE: XOM) |

China Construction Bank (SHA: 601939) |

Visa Inc (NYSE: V) |

|

General Electric Company (NYSE: GE) |

UFJ Bank |

Lucent Technologies |

Royal Dutch Shell Plc (AMS: RDSA) |

Nestle |

|

Eastman Kodak Company (NYSE: KODK) |

Exxon |

Deutsche Telekom AG (ETR: DTE) |

Nestle SA (SWX: NESN) |

Procter & Gamble Co (NYSE: PG) |

|

Survivors from previous decade: |

2 |

2 |

3 |

3 |

|

Source: PM Capital; Table created by author |

||||

So what does this mean?

The frequent turnover means a company currently among the largest has very little upside. In fact, it will be a struggle to just maintain the status quo and stay one of the largest.

So why would any investor put money into a company that has few upward prospects?

"An investor is more likely to pick the top for those stocks than get in at the bottom or at reasonable valuations," Moore said.

"Smart investors may want to consider how exposed they, and their managed funds, are to the top 10 stocks."

Buying up these giants goes against the classic axiom of not letting past performance dictate investment decisions.

The rise of index funds and exchange-traded funds (ETFs) has exacerbated the problem. The most-owned stocks become even more overheated because passive funds are obliged to buy into them.

Then they become larger and the funds have to buy even more – it's a self-feeding cycle.

Which companies will make the top 10 in 2030?

Moore said wise investors would try to figure out the top 10 of the next decade.

And the arrival of the coronavirus pandemic and market crash presented a "once-in-a-lifetime" chance to pick out sunken "quality cyclical and industrial" shares.

"For example, commodity stocks post COVID-19 were at an all-time low compared to the rest of the market," he said.

"Stocks like Teck Resources Ltd (NYSE: TECK) and Freeport-McMoRan Inc (NYSE: FCX) have gained significant ground since the March lows but their valuations remain reasonable when considered against their long term outlooks."

The winning shares in the next 10 years would be those that drive "secular trend shifts", such as copper usage in global electrification, according to Moore. Those positioned for the forthcoming cyclical economic recovery would do well too.

"While they are unlikely to all end up in the top 10 of the MSCI World Index, we believe they will grow at a greater rate than the overall market and provide adequate investment returns."