Technology darlings have been leading the global market sell-off and have put investors on edge. But the shake-up may be an opportunity to buy these two ASX tech stocks.

Don't mind the noise even as our S&P/ASX 200 Index (Index:^AXJO) is poised to open weaker after stocks like Apple Inc. (NASDAQ: AAPL) and Alphabet Inc Class C (NASDAQ: GOOG) pushed US indices to a six-week low.

Rapid P/E re-rating makes tech stocks vulnerable

Hot technology stocks on the ASX have also come off the boil recently as investors question the lofty premiums that the sector is trading at.

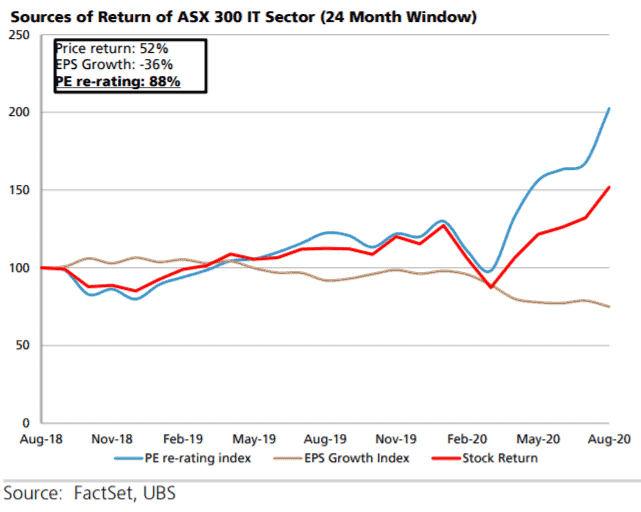

In fact, the very strong outperformance of ASX tech stocks since the outbreak of the COVID-19 pandemic is driven by a price-earnings (P/E) re-rating.

As the chart from UBS below shows, the share price rally from the likes of the Afterpay Ltd (ASX: APT) share price and its friends, isn't driven by earnings growth.

What does P/E expansion mean

It is the anticipation of future growth that is convincing investors to pay more for these stocks than they would have otherwise before COVID-19.

In other words, the expanding P/E means investors are paying more for each dollar of earnings. Tech stocks in both Australia and the US are priced for perfection, and any setback will trigger a sharp sell-off.

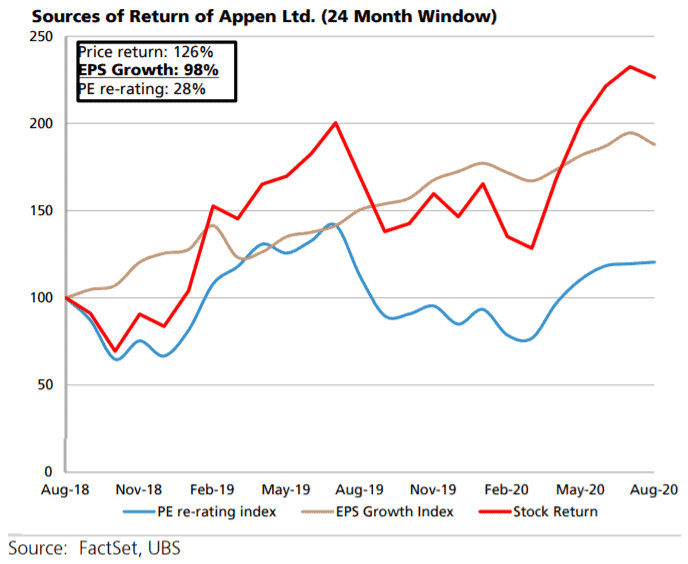

But there's a small handful of tech stocks that are outperforming due more to earnings growth than the P/E re-rating.

The best ASX tech stocks to buy in this sell-off

One example it the Appen Ltd (ASX: APX) share price. UBS estimates that earnings per share (EPS) growth accounted for nearly 80% of the share price performance of the machine learning and artificial intelligence company.

Appen isn't alone. The Nanosonics Ltd. (ASX: NAN) share price is much in the same boat, even though Nanosonics is not quite an IT but a medical technology stock.

But we are splitting hairs here. The more relevant detail is that earnings growth accounted for 54% of Nanosonics share price performance in the last two years.

For this reason, UBS put the two stocks into its "preferred list" of ASX stocks to buy. At least from a risk perspective, the two stocks are technically less vulnerable to a P/E de-rating.