While the change in the US Federal Reserve inflation policy late last week failed to translate to any meaningful gains for the S&P/ASX 200 Index (Index:^AXJO), make no mistake that this will impact on your ASX portfolio.

The move by the Fed to use the average inflation to control price increases excited US investors. This is because it clears the way for the US central bank to ramp up stimulus as it isn't constrained by fears of a short-term surge in inflation.

The Reserve Bank of Australia isn't as aggressive as their US counterparts, but the Fed's policy change will have implications for ASX investors.

ASX stocks facing more uncertainty in FY21

The irony is that equities aren't necessarily the biggest beneficiaries of this, and in fact, may be a loser from the move to Average Inflation Targeting (AIT).

By introducing greater flexibility in the inflation target, the Fed is likely to increase inflation volatility, warned Credit Suisse.

And we know from the COVID-19 fallout (and all other crises for that matter) is that volatility is investors' worst enemy.

"The worry for equity investors is that higher inflation volatility transmits directly to market valuations, independently of rates and yields," said Credit Suisse in a note on Friday.

"This is because inflation has ambiguous effects on corporate profit margins, depending on whether it is 'cost-push' or 'demand-pull' in nature."

Rising risk premium a threat to ASX bull market

Greater uncertainty in the outlook for inflation will push risk premiums higher. A risk premium is the extra protection investors demand if they are to buy shares. The bigger the premium, the lower share prices need to be to entice them.

The ASX looks vulnerable to any increase in the risk premium given its big surge since bouncing from the depth of the bear market in March.

This may be bad news for our share market on the whole, but there's a silver lining for our embattled ASX banks.

ASX banks catching a rare break

I noticed that the yield curve is steepening after the Fed's signal it will move to AIT. The willingness for the US central bank to accept more upward pricing pressure is driving longer-dated bond yields higher.

The 10-year Australian Commonwealth Government Bond (ACGB) jumped 13 basis points to 1.04% on Friday, which is a big move for such securities.

Meanwhile, the 3-year ACGB remained largely where it as the RBA committed to keeping the yield on this duration at 0.25%.

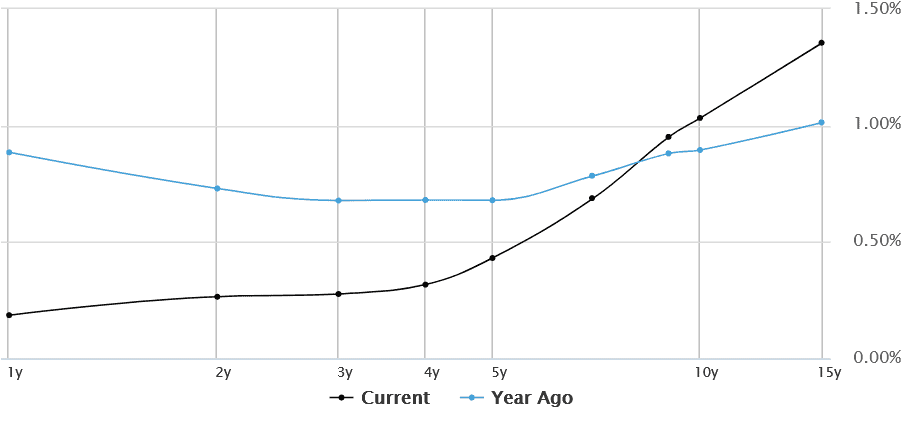

As the graph below shows, the spread between short-term to longer-term ACGB is getting wider, thus steepening the yield curve.

Steepening Yield Curve (now vs. 1 year ago)

Source: MarketWatch

This is welcomed news for the likes of the Commonwealth Bank of Australia (ASX: CBA) share price, Westpac Banking Corp (ASX: WBC) share price, National Australia Bank Ltd. (ASX: NAB) share price and Australia and New Zealand Banking GrpLtd (ASX: ANZ) share price.

Small victory

Banks generally benefit from a steeper yield curve as they can borrow short-term funds at a lower rate and lend long.

Of course, there are a lot of moving parts impacting on bank profits at the moment, so a steeper yield curve on its own isn't enough to turn sentiment, but we need to celebrate every small victory in this volatile environment.

Another group of ASX winners

Another group that will benefit from inflation volatility is commodities. This is particularly so for the safe-haven gold price, in my view.

The Newcrest Mining Limited (ASX: NCM) share price and Evolution Mining Ltd (ASX: EVN) share price have underperformed in August as the price of the precious metal retreated from record highs.

Any material pull-back in gold mining shares is a buying opportunity, in my view. This is particularly so because the US dollar is in for a sustained period of weakness as the Fed injects more stimulus to support the American economy.