Is the Australian Foundation Investment Co.Ltd. (ASX: AFI) share price good value right now?

Australian Foundation Investment Co (AFIC) is Australia's oldest and largest investment manager, having been founded in 1928.

Many ASX share investors know AFIC as a reliable ASX dividend share. In fact, the Aussie fund manager did well during the global financial crisis and even maintained its distributions.

However, it doesn't look so good this time around.

The AFIC share price climbed 0.7% on Monday and another 0.97% yesterday, despite announcing a 40.8% drop in profit.

So, what was driving AFIC's full-year result and what does it mean for a keen-eyed investor?

What was in AFIC's full-year result?

The investment group's net profit came in down 40.8% to $240.4 million. It was a similar story with operating revenue which fell 40.1% to $264.3 million.

Net tangible assets per share before the final dividend came in at $5.96 per share. That's down from $6.49 per share at 30 June 2020, representing an 8.2% year-on-year decline.

The AFIC share price is currently trading at $6.24 per share, down 13.11% in 2020.

AFIC announced a fully-franked final dividend of 14 cents per share. That's on par with last year's distribution, with AFIC shares to trade ex-dividend on 11 August.

A 40.8% drop in profit doesn't sound like good news. However, there were a number of one-off items that were not repeated this year. That included participation in off-market share buybacks for Rio Tinto Limited (ASX: RIO) and BHP Group Ltd (ASX: BHP) as well as last year's special dividend from Wesfarmers Ltd (ASX: WES).

What does this mean for ASX investors?

Clearly, shareholders weren't too disappointed by the news. At the time of writing, the AFIC share price is up 1.8% since Monday and 29.5% since 24 March.

AFIC's 10-year return now sits at 9.3% on an annualised basis compared to 9.4% for the S&P/ASX 200 Accumulation Index (ASX: XJOA).

I think investors will be keen to see where AFIC is looking for their own portfolios.

Key acquisitions during the year include Goodman Group (ASX: GMG) and Telstra Corporation Ltd (ASX: TLS).

There were several big disposals such as Treasury Wine Estates Ltd (ASX: TWE) and Scentre Group (ASX: SCG).

Among the new companies added to the portfolio were Altium Limited (ASX: ALU) and Netwealth Group Ltd (ASX: NWL).

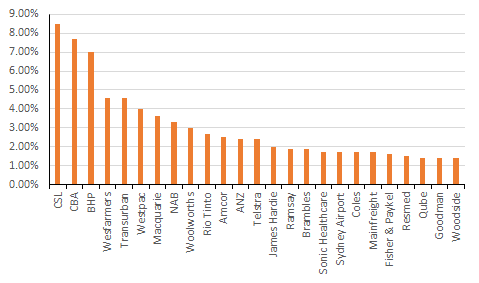

It's perhaps unsurprising that a lot of big names from the S&P/ASX 200 Index (ASX: XJO) are present in AFIC's portfolio. I've included the portfolio's top 25 holdings as at 30 June 2020 in the graph below.

These 25 ASX shares make up 76.3% of AFIC's portfolio value. That means the performance of shares like CSL Limited (ASX: CSL) will be the key to where the AFIC share price will finish in 2020.

Foolish takeaway

Given the share price movement this week, investors didn't mind the 40.8% profit drop from the Aussie listed investment company.

AFIC did report that the outlook "remains unclear". In particular, the company said it was "difficult to reconcile the expansion of market valuations with the pressure on company profits, and dividends are likely to remain under."

That's pretty telling from the Aussie fund manager and a potentially ominous warning.

However, I wouldn't be betting against the AFIC share price climbing higher in the next 12 months.