FAANG stocks. They're hot property right now and leading United States shares on a bullish run in 2020.

But it's not easy for us Aussies to invest overseas. Not without a specialised broker and/or significant tax and currency headaches.

However, all that is starting to change thanks to a new exchange-traded fund (ETF). Which one? The ETFS FANG+ ETF (ASX: FANG).

What is 'FAANG'?

FAANG is the acronym used for some of the biggest US tech stocks right now.

The members of FAANG are Facebook Inc. (NASDAQ: FB), Amazon.com Inc. (NASDAQ: AMZN), Apple Inc (NASDAQ: AAPL), Netflix Inc (NASDAQ: NFLX) and Alphabet Inc. (NASDAQ: GOOG) which is Google's parent company.

For what it's worth, Australia has created its own hot tech acronym. The 'WAAAX' tech shares include WiseTech Global Ltd (ASX: WTC), Afterpay Ltd (ASX: APT), Altium Limited (ASX: ALU), Appen Ltd (ASX: APX) and Xero Limited (ASX: XRO).

But enough with the acronyms, how do you actually buy FAANG stocks through the ASX?

How to invest in FAANG stocks on the ASX

The bad news is that you can't technically buy the individual FAANG stocks through the ASX.

The good news is that you can get diversified exposure to the whole group and more in the one ETF.

The ETFS FANG+ ETF started trading on the ASX on 27 February this year. The fund seeks to track the NYSE®FANG+™ Index by investing in a portfolio of FAANG stocks and more.

It's worth noting that the fund is not currency-hedged, which means you are exposed to currency risk through movements in the US-Australian dollar. The FANG+ ETF is rebalanced quarterly and has a management fee of 0.35%.

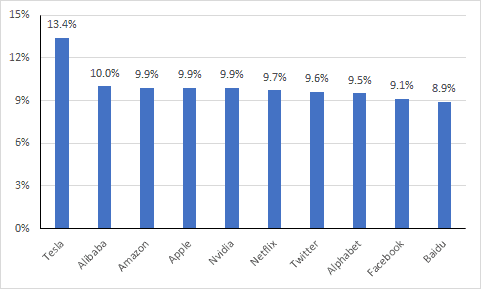

I've included a chart below of the fund's top holdings by percentage weighting as at yesterday's close.

As you can see, all the big FAANG stocks (and more) have significant weightings in the fund.

The ETF has climbed 31.5% higher since 2 March compared to a 4.8% decline in the S&P/ASX 200 Index (ASX: XJO).

That means if you're looking for an easy way to get exposure to these shares in 2020, this ETFS FANG+ ETF could be for you.

What about the alternative ways to invest?

If this ETF doesn't cut it, there are other ways to invest in US FAANG stocks. One is direct investment but you would need to find a broker that allows offshore investments.

You could also buy a diversified US ETF like iShares S&P 500 ETF (ASX: IVV). The FAANG stocks make up a significant portion of the S&P 500 by market capitalisation.

This iShares ETF has a management fee of just 0.04% compared to 0.35% for the ETFS FANG+ ETF. That could make it a good reason to buy for the long term and generate strong after-tax returns.