Early retirement is a goal or dream I'm sure most people share. However I believe that with a little smart saving and investing early, over time this dream can become a reality.

To see how, we will start by looking at a persons total economic wealth, showing how they can move into the retirement phase from the accumulation phase more quickly.

Total economic wealth

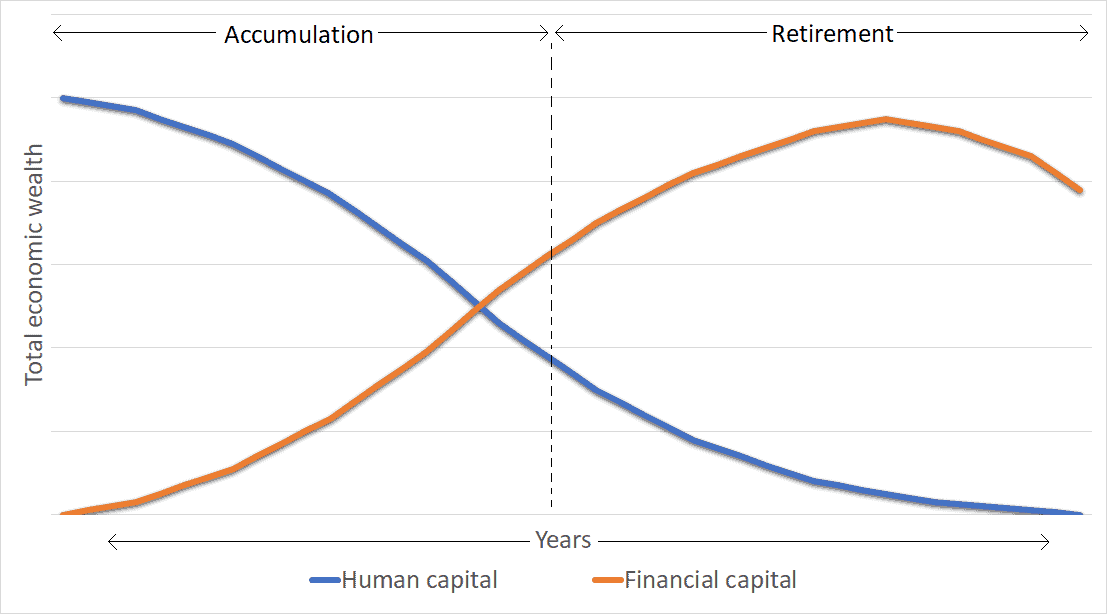

At any time in a person's life, total economic wealth is represented as the sum of their financial capital and human capital.

What is financial capital?

Financial capital is basically the sum of all your assets minus your debts.To calculate your financial capital, add up all your savings, share portfolio, superannuation, properties etc, and subtract any debts such as mortgages or student loans you may have.

Obviously financial capital is lower for most people when they are younger as they have not yet had the time to grow their wealth. However, this is where people who are more responsible with their money can see it grow much faster as the effects of compounding take hold. This will help push them closer to their retirement phase.

What is human capital?

Human capital can be thought of as the present value of a person's expected income from employment throughout their entire life. As you enter the workforce, your human capital is at a maximum since you have the greatest number of years left to work until retirement. Hence as you age and work, your human capital decreases.

So what does this mean?

Roughly speaking, human capital and financial capital are inverse to each other. This can be seen through the chart below.

Chart by author

As a working person ages, their human capital begins to reduce as part of their future earnings are realised. A portion of this income will be saved and often used to pay down a mortgage. In addition, their superannuation will increase as it is paid by their employer. All of these items will increase their financial capital. This continues through the accumulation phase until enough financial capital has been raised to support them through retirement.

So it appears that the solution to being able to retire early is by growing your financial capital as quickly as possible. This doesn't mean through risky investments, but instead by starting early and investing regularly. Which is where I believe ASX shares should come into the picture.

How to grow your financial capital

ASX shares have been a phenomenal tool for people to grow their financial capital. This is something I don't believe will change any time soon. In fact, looking into the majority of superannuation funds, you will see large allocations to shares – both Australian and international.

Your superannuation in designed to support you during retirement, while our goal is to bring retirement forward. This means investing outside of your superannuation, regularly.

Growing a large portfolio to replace your income prior to retirement may sound daunting. However, one of my fellow writers has shown here that by investing just $1,000 a month you can achieve a share portfolio of $1,000,000 in less than 24 years. Breaking it down into monthly goals is a great way to make the process more achievable.

Of course the sooner you start the better, and I believe now is a great time when you're focusing on 10, 20 or 30 years down the road.

I would consider investments today in shares like Washington H. Soul Pattinson and Co. Ltd (ASX: SOL), Vanguard FTSE Asia ex Japan Shares Index ETF (ASX: VAE) and BetaShares NASDAQ 100 ETF (ASX: NDQ).