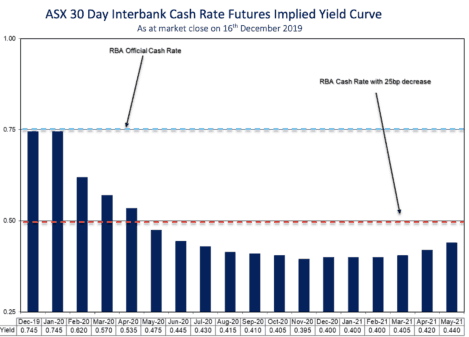

According to the ASX 30 Day Interbank Cash Rate Futures, the market expects the Reserve Bank to cut the cash rate down to 0.5% by May of next year.

This can be seen on the chart below, courtesy of the ASX.

Unfortunately for income investors, I think there's a strong possibility of this occurring. Which means the paltry interest rates on offer from savings accounts and term deposits could be about to get even worse.

But don't worry, because the three ASX dividend shares listed below could be great alternatives for income investors. Here's why I like them:

Coles Group Ltd (ASX: COL)

Although it doesn't provide the biggest yield, I still feel Coles could be a great long term option for income investors. This is because I believe the supermarket giant is well-placed for growth over the next decade thanks to its strong market position, expansion opportunities, and its refreshed strategy. The latter is aiming to strip out significant costs through efficiencies and automation. I believe this bodes well for its dividend, especially given the company's aim of paying out 80% to 90% of its earnings to shareholders. Based on this, I estimate that its shares currently offer a fully franked forward 3.5% dividend.

Sydney Airport Holdings Pty Ltd (ASX: SYD)

Another ASX dividend share I would buy instead of term deposits is Sydney Airport. As the operator of the country's busiest airport, it looks well-positioned to continue growing its dividend at a solid rate over the coming years. Especially considering growing international tourism and a recovery in the domestic travel market. This should lead to increasing numbers passing through its gates in 2020. At present Sydney Airport's shares offer a trailing 4.3% dividend yield.

Transurban Group (ASX: TCL)

A final dividend share to consider buying is toll road operator Transurban. With congestion on arterial roads seemingly getting worse each year, the company's portfolio of toll roads continues to experience growing traffic numbers. And it isn't hard to see why. In FY 2019, its customers collectively saved 374,000 hours in travel globally. This is 14% higher than the same period a year earlier. This convenience gives Transurban a lot of pricing power, which I feel bodes well for its distribution growth. This year the Transurban board intends to increase its distribution to 62 cents per security, which works out to be a forward 4% distribution yield.