Choosing the right ASX shares to fund your retirement can be an enormously stressful situation to find oneself in. Everyone has the benefit of knowing exactly how much money went in and out of every ASX-listed company last year. But knowing what a company might make 5, 10, 20 or 30 years down the track (or if they'll even be around) is an entirely different kettle of fish.

The old Fairfax Media is one classic example. Back in the 1990s, Fairfax was viewed as the bluest of the ASX dividend blue-chips with its tight grip on the classified advertising market across the country. But fast forward to today, and Fairfax is now part of the Nine Entertainment Co Holdings Ltd (ASX: NEC) group – bought for a shadow of its former worth last year after being decimated by the internet age.

This cautionary take underscores the importance of understanding a business and where it fits in to the wants and needs of the Australian consumer – especially before choosing said business for your retirement portfolio.

That's why I want to discuss Wesfarmers Ltd (ASX: WES) today. For 3 different reasons, I believe Wesfarmers is a perfect stock to hold in your retirement portfolio. But first…

A brief history of Wesfarmers

Wesfarmers' origin story goes back to 1914 as a Western Australian farmers' cooperative. Its first official title was Westralian Farmers Co‐operative Limited, which is where the name we know it as today hails from. For many of Wesfarmers' first decades, the company solely focused on the buying and selling of Western Australian agricultural goods. But in the post-war era, the company began branching out into a range of other industries, including gas, fertiliser manufacturing, insurance and transportation.

Wesfarmers publicly listed on the ASX in 1984 for a market capitalisation of $80 million and initially maintained a cooperative share structure. However, the last legacies of this were wound up in 2001.

Today, Wesfarmers is a sprawling conglomerate with dozens of subsidiary companies across a range of industries. Until the demerger of Coles Group Ltd (ASX: COL) last year, Wesfarmers was the largest Australian company by revenue, and also the largest private employer in Australia.

On current prices, the company has a market capitalisation of $46.39 billion, which makes it the 9th largest public company in the country.

What makes Wesfarmers a perfect retirement stock?

As I mentioned above, there are 3 reasons I view Wesfarmers as a perfect stock for a retirement portfolio.

Reason 1: Diversification

Many Australians outside the world of investing may not have even heard of Wesfarmers – but they would have certainly heard of at least a handful of the companies that Wesfarmers either owns or has an interest in.

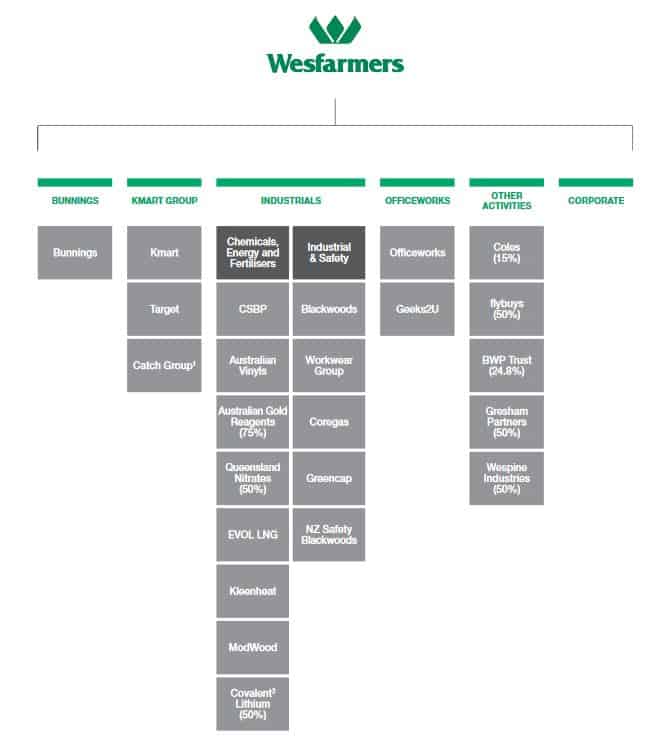

Take a look at this chart and see for yourself.

Source: Wesfarmers (2019 Annual Report)

As you can see, Wesfarmers divides its businesses into 5 broad categories – the Bunnings Group, the Kmart Group, the Officeworks Group, Industrials and Other Businesses.

Here is a breakdown of each category:

- Bunnings Group – Contains the wildly successful Bunnings Warehouse chain of hardware suppliers, as well as the 'Bunnings Trade' subsidiary.

- Kmart Group – Houses the Kmart discount store chain as well as the Target network of stores, which operates in a similar field but with a heavier focus on clothing.

- Officeworks Group – Officeworks is a warehouse-style business that sells office supplies, stationary electronics, printing services as well as almost any product conceivably required for office-based commercial work (even tea and coffee). Also included in this group is the recently acquired 'Geeks-2-U' computer repairs company.

- Industrials – the largest group by number of interests, if not by earnings power. Industrials are further divided by Wesfarmers into Chemicals, Energy and Fertilisers (WESCEF), and Industrial and Safety. WESCEF includes everything from Kleenheat Gas and CSBP Fertiliser to EVOL LNG, Queensland Nitrates and Australian Gold Reagents, along with many others. Industrial and Safety includes tool-maker Blackwoods and Workwear, which houses well-known clothing brands like King Gee, Wolverine and Hard Yakka.

- Other Businesses – This is where Wesfarmers' 15% stake of Coles is held, along with a 50% ownership of the Flybuys loyalty program and a 24% stake in property company BWP Trust (ASX: BWP). Gresham Partners (financial services) and Wespine Industries (sawmilling) are also included.

As you can see, this enormous stable of businesses gives Wesfarmers many fingers in many pies, and a huge level of earnings diversification across the entire Australian economy. This is a massive advantage for any shareholders of Wesfarmers as it is unlikely that any industry-specific changes or challenges that affect any of its subsidiaries would significantly hurt the underlying strength of the parent.

Reason 2: Flexibility

Having so many sources of revenue also gives this company significant agility and flexibility in moving into new fields (and out of old ones). In the last few years, Wesfarmers has shown it has been willing to do both. Its demerger of Coles was (in my opinion) due to management's view that the business would be of more benefit to shareholders outside the Wesfarmers sphere – a view that has been arguably vindicated by the performance of COL shares over 2019.

Similarly, the acquisition this year of Kidman Resources – a WA-based lithium producer – shows how Wesfarmers can move into fields where it sees value for shareholders. The lithium sector has been struggling with low prices for the past year or two, which means Wesfarmers (in my opinion) waited for the right moment to strike.

With the rise of electric vehicles and power-managing battery technology (of which lithium is a key ingredient), this is an area with a lot of future potential. Hence, the Kidman acquisition shows me that Wesfarmers is not sitting on its laurels and is willing to chase future growth areas.

Reason 3: A history of shareholder returns

Last but certainly not least is Wesfarmers' history of delivering for its shareholders, including through the payment of fully franked dividends. Including said dividends, WES shares have returned a total of 80.4% over the past 5 years to their owners, which compares well with the 60.6% that the broader S&P/ASX 200 (INDEXASX: XJO) has returned.

The spin-off of Coles has reduced the dividends the company has been able to pay since the demerger, but I still estimate WES shares (on current share prices) to offer a forward dividend yield of 3.6% going into next year (or 5.14% grossed-up with franking). That's not quite as high as what some other ASX shares are currently offering (mainly the big four banks), but more than adequate for such a strong and diversified earnings base, in my view. Wesfarmers shares have also appreciated around 30% so far in 2019, which has also pushed the yield you can expect from WES shares down as the price has climbed.

Since Wesfarmers has paid a dividend every year since 1997, I fully expect the shareholder payments will continue to form a strong component of the total shareholder returns investors can expect from this company into the future.

Foolish takeaway

I think at today's pricing levels, WES shares offer a well-balanced mix of capital growth potential and steady income. Not many companies can boast such a long and impressive history of growth and acquisitions.

But it is Wesfarmers' diversified earnings base, the company's proven ability to be flexible with its investing focus and its history of delivering shareholder returns that (I believe) makes this company a perfect candidate for a core holding in a retirement portfolio. Wesfarmers shareholders have long been a happy bunch, and I don't see this changing in the months and years ahead.