On Monday, Saracen Mineral Holdings Ltd (ASX: SAR) announced the transformational acquisition of 50% of the Super Pit. The Super Pit (as the name suggests) is a large, high quality, long-life open pit and underground gold mine located in the globally renowned Golden Mile Region of Kalgoorlie-Boulder, Western Australia. To finance this deal, Saracen intends to raise approximately $796 million.

Premier Australian gold mine

The Super Pit produced 730koz of gold in FY2018. To put things into perspective, Saracen's FY20 group guidance (pre-acquisition) was 350–370,000 oz. The company will be partnering with Newmont Goldcorp, the world's leading gold company with extensive experience in large scale open pit and underground operations.

Saracen climbing the ranks

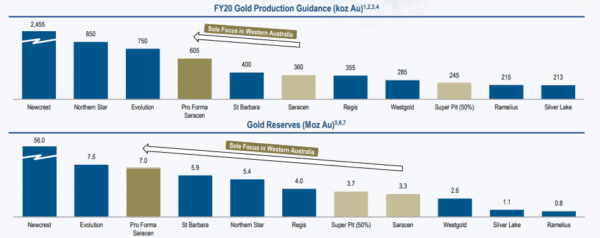

The acquisition pushes Saracen from a mid-tier growth story to a top-tier gold producer with better growth capabilities. The Super Pit will position Saracen in the same league as Australia's top producers such as Evolution Mining Ltd (ASX: EVN) and Northern Star Ltd (ASX: NST).

As displayed above, the Super Pit will enhance Saracen's portfolio, with reserves increasing by 111% and resources up 63%. Its pro forma FY20 production is anticipated to be up 68% to 605koz at an all-in sustaining cost (ASIC) of $1,220 (up from A$1,050/oz). While ASIC will be higher, the company will still receive healthy margins given the low Australian dollar and solid gold spot price. The current gold spot price, in Australian dollars, sits at a healthy $2,100 level.

The acquisition will be highly accretive to various metrics including earnings per share, free cash flow per share and net asset value per share.

Saracen share price today

The Saracen trading halt has been lifted and its share price is down approximately 9% at the time of writing.

Saracen has a market capitalisation of approximately $2.55 billion, so an almost $800 million raise is significant. The retail and institutional offer was also at an offer price of $2.95, which represents a significant discount to its pre-capital raising share price of $3.40.

The capital raising was well received with approximately 74% of eligible institutional shareholders taking up their entitlements. This raised approximately $369 million. The retail entitlement offer will now be available and closes on 6 December 2019.

While the acquisition is transformational and beneficial to the businesses various metrics, the sheer size, dilution and discount will negatively impact the share price in the short term. Once the market overcomes the discount price and dilution, Saracen should be a strong gold performer in the medium–long term.