The MNF Group Ltd (ASX: MNF) share price has now rocketed 49% from $3.63 in early August to $5.40 today thanks to a decent half-year that saw a return to positive free cash flow and forecast for strong growth in FY 2020.

The voice-over-internet (VOIP) business is founder led, boasts a reasonable balance sheet and has a strong long-term track record of growth.

For the 6 months to June 30 2019 it reported underlying NPAT-A growth of 13% to $15.9 million on adjusted earnings per share growth of 12% to 21.7c. It also paid a final dividend of 4 cents per share to take full year dividends to 6 cents per share.

Over the years MNF Group has grown organically and via a reasonably aggressive acquisition strategy with its FY 2019 acquisition of 'In-a-Box' earnings per share accretive and due to be integrated by December 2019.

MNF has also been investing heavily in building out its VOIP global structure including the physical space and hardware required for new points of presence in the US, Europe, and Asia Pacific region.

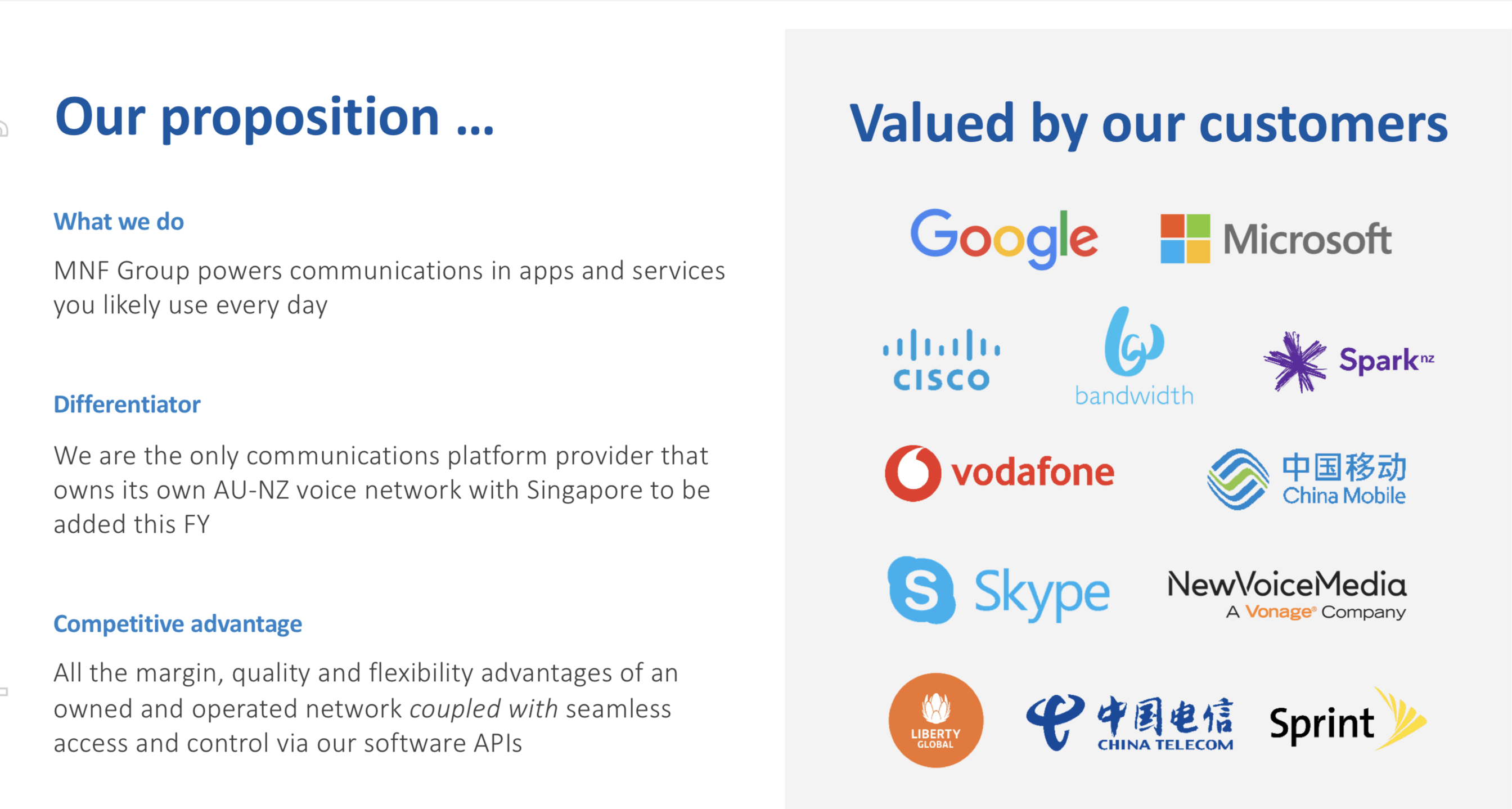

Aside from the acquisitions, the company's core strength since the beginning has been its building and ownership of Australia's only full VOIP network, with it now in the process of building out an equivalent fully owned network in Singapore.

Below you can see a rough guide on its core business plan.

Source: MNF presentation Sept 23, 2019.

I've always been impressed by its entrepreneurial founder Rene Sugo and its wider management team, but must admit to selling most of my holding at lower prices due to concerns over its Pennytel mobile virtual network (MVNO) plans in regional Australia.

The plan to offer baby boomers cheap mobile plans in regional Australia by piggybacking off the Optus network always seemed left field and it appears the business is largely sweeping it under the carpet nowadays.

In hindsight my loss of patience looks like a mistake and the stock has got a wriggle on since management presented to some powerful US investors around September 23, 2019. The US is full of loaded tech investors and the cheap Aussie dollar is also attractive.

Taking the mid-point for guidance of adjusted earnings of 26 cents per share in FY 2019 the stock at $5.40 is on a forward price-to-earnings ratio of 21x with a yield likely to be around 1.2%. That looks reasonable value for a business still investing for growth with a good track record in the tech sector.

I wouldn't be averse to buying more shares today, although I must concede this article would have boasted far more utility if posted when the stock traded around $4 only 6 weeks ago.

Other juniors in the communications sector I'm not quite so keen on include Superloop Ltd (ASX: SLC), Megaport Ltd (ASX: MP1) and 5G Networks Ltd (ASX: 5GN).