In a day where the S&P/ASX200 (ASX: XJO) got a haircut (down 0.48% at the time of writing), the Afterpay Touch Group Ltd (ASX: APT) share price was a standout performer. Afterpay shares are up a massive 13.31% and are currently swapping hands for $36.00 after making a fresh new all-time high of $36.65 yesterday morning.

Why are Afterpay shares hitting the roof (again)?

As my Foolish colleague James Mickeboro reported yesterday morning, Afterpay released a report updating the market on its dealings with the government body AUSTRAC. AUSTRAC had asked Afterpay to explain how its services could or could not be used in money laundering and other illegal activities. In yesterday's interim update, the company gave a positive sign that its management has not identified any money laundering or terrorism financing activity via its systems to date, although it intends to provide more information when the final report is released.

Further, investment bank Goldman Sachs has also updated its Afterpay price target to $42.90, which has no doubt added to investors excitement.

What does the future hold for Afterpay?

I still think the biggest threat to Afterpay is its lack of 'moat', as Warren Buffett would say. The only advantage I see Afterpay having is its branding, which is significant, but open to erosion over time. Afterpay's potential competitors range from local rivals like Zip Co Ltd (ASX: Z1P) and Splitit Ltd (ASX: APT) to our ASX banks like Commonwealth Bank of Australia (ASX: CBA) and even the US payment behemoths Visa and Mastercard.

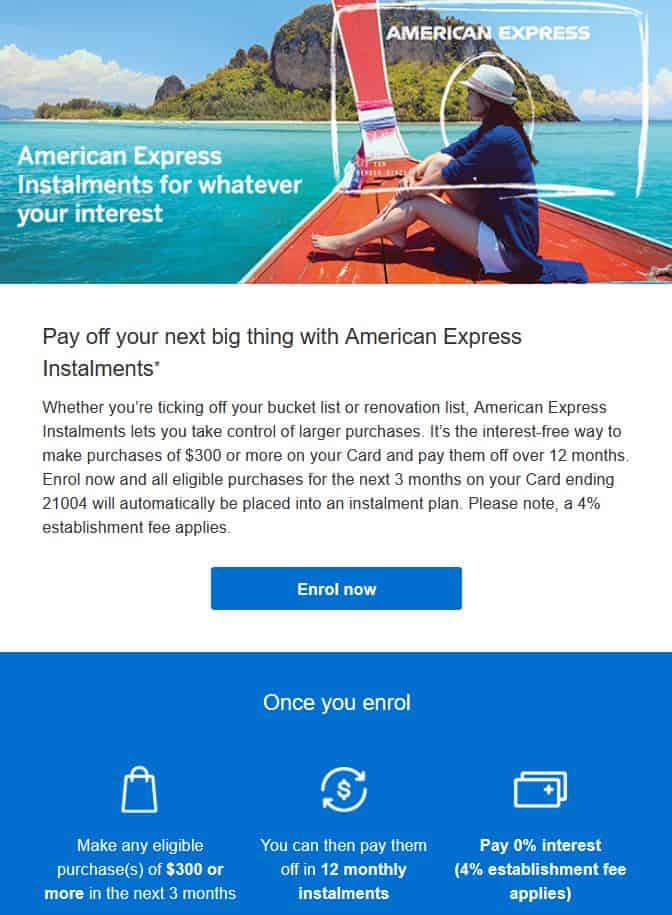

What's more, I received an email from American Express Co. yesterday. See if you can spot something below that might make Afterpay shareholders take pause.

Source: American Express

Exactly… the 'instalments' appeal has certainly taken root, and if Amex finds a profitable route into this space, it might have the potential to derail Afterpay's US expansion plans.

Foolish takeaway

As Afterpay investors would know, the US is the 'promised land' where the company is most bullish – particularly given its population size. But as Afterpay only launched there last year, it might not have the branding advantage it has entrenched in our country. Afterpay's progress has been wildly successful so far, but I see trouble on the horizon once the US giants start to really throw down the gauntlet.