Blue-chip shares are commonly favoured by SMSF investors, retirees, or 'mums and dads' due to their perceived defensiveness. However, every business in the share market comes with substantial risk. Even large-cap favourites can lose half their value in a matter of months on the back of a bad operating update or profit downgrade.

On the other hand beaten-down large-caps can occasionally represent 'turnaround' opportunities for investors looking to make good money.

Investors should be careful though as Warren Buffett famously said 'turnarounds seldom turn' in the share market. And not for nothing either.

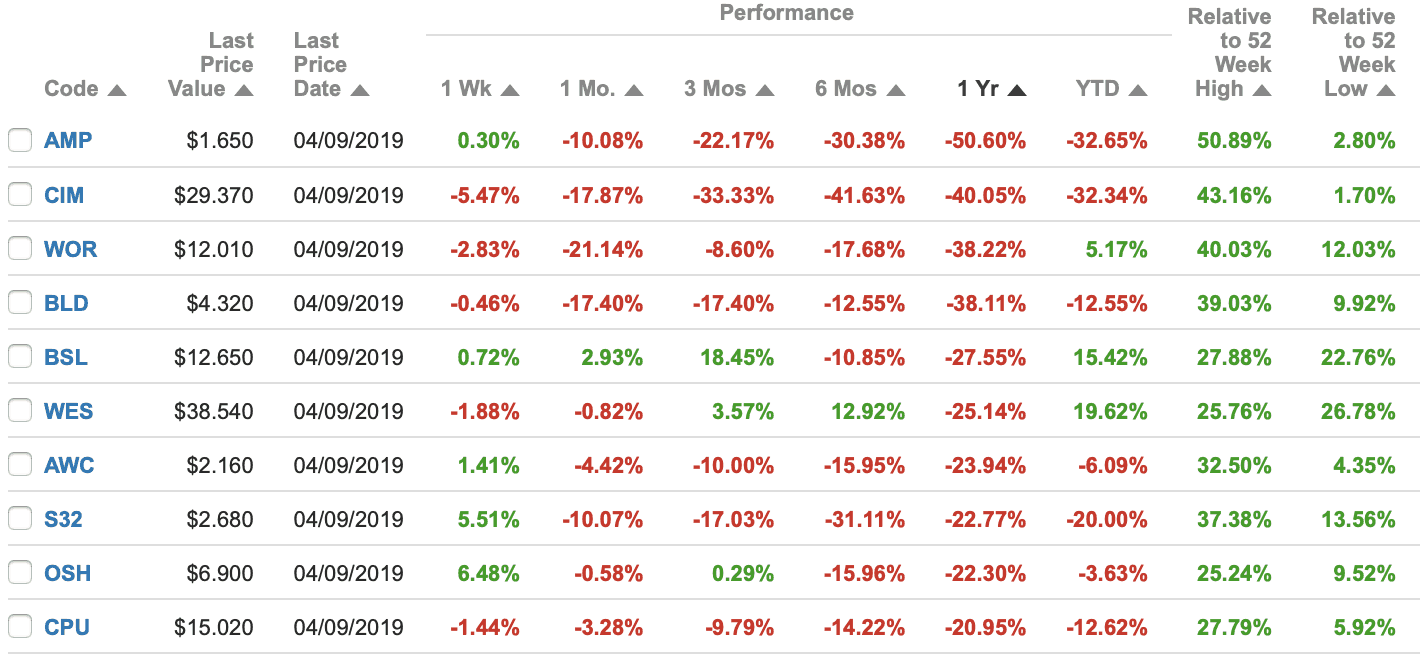

So with that in mind, let's take a look at the 10 worst-performing large-cap shares over the past year.

Source: Commsec, Sept 5, 2019.

AMP Limited (ASX: AMP) is the financial advice and insurance giant that lost half its value after it was hauled over the coals at the Royal Commission into financial services. The damage led to its dividend being scrapped entirely for the period to June 30, 2019.

Cimic Group Limited (ASX: CIM) is the construction business that has flagged numerous problems within its engineering division over the course of 2019. As a result investors have marked the stock down 40%.

Worleyparsons Limited (ASX: WOR) shares are down 38% after management declined to provide an earnings forecast for FY 2020 and warned investors it faced "global macro-economic uncertainty".

Boral Ltd (ASX: BLD) is the Australia and US focused building materials business that revealed revenue and earnings per share fell by mid-single digits over FY 2019.

Bluescope Steel Ltd (ASX: BSL) is the steel manufacturer that came under pressure in FY 2019 on the back of concerns a tariff war between the US and China would hurt demand for steel by the world's two major economic superpowers.

Wesfarmers Ltd (ASX: WES) is the investment conglomerate looking to push into the lithium and rare earths space by acquisition. Its crown jewel remains the dominant Bunnings Warehouse business.

Alumina Limited (ASX: AWC) is the alumina manufacturer that has also suffered a slowdown partly blamed on the US / China tariff war.

South32 Ltd (ASX: S32) primarily mines coal, aluminum, nickel and silver where price rises have not been as strong as iron ore or gold for example. It also battled what analysts claimed were rising costs in FY 2019.

Oil Search Limited (ASX: OSH) is the PNG-focused LNG producer that suffered production and sales timing delays in FY 2019. As a result investor marked the stock down 22%.

Computershare Limited (ASX: CPU) might surprise some to be down 21% over the past year. This is probably the result of its valuation getting ahead of itself and as the US Fed turned from hawkish to dovish over FY 2019 to deliver a cash rate cut. Generally, Computershare is considered a beneficiary of rising risk free rates as it can make better returns on its huge free float.