The best ASX gold miners are rocketing again this morning and the rising gold price is a topic I've covered regularly over the past few months. Some Australian gold miners are probably now printing net profit margins over $1,000 per ounce of gold sold with this afternoon's gold price at US$1,551 to equal A$2,302.

This is because local gold miners will commonly have all in sustaining costs (AISCs, or total costs including production, shipping, etc) of around A$1,300 per ounce of gold mined to mean they'll be making a mint at today's prices.

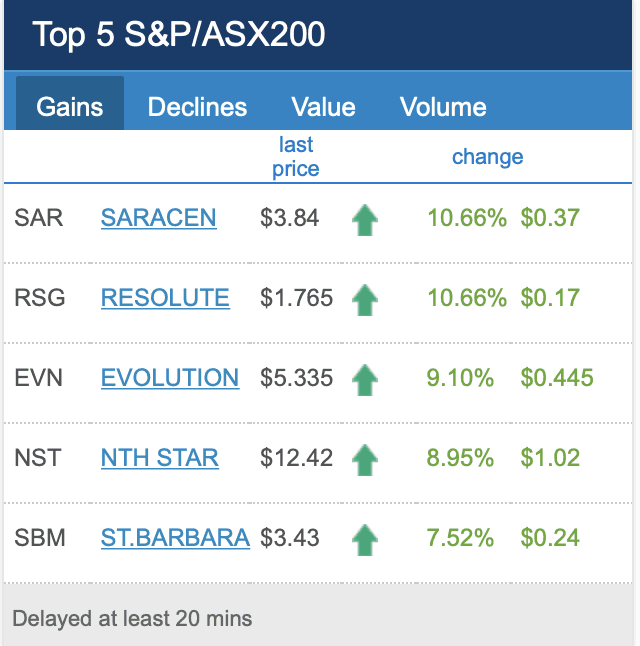

Check out the leading positions of Saracen Minerals Ltd (ASX: SAR), Resolute Mining Limited (ASX: RSG), Evolution Ltd (ASX: EVN), Northern Star Resources Ltd (ASX: NST) and St Barbara Ltd (ASX: SBM) on the ASX leaderboard this afternoon.

Source: ASX website, Aug 26, 2019.

The gold price can move in mysterious ways, but since the start of financial markets has generally appreciated as a 'flight to safety' trade or store of value when other capital markets are collapsing. This was the case during the GFC, or 2012 Greek debt crisis when gold last peaked around US$1,800 an ounce.

This time a few new geopolitical factors are arguably combining to encourage powerful investors to bid gold higher.

A brief outline follows below.

First, we have the growing tariff war between the US and China that is hurting GDP growth which depends on trade. This is causing ructions in financial markets to send gold higher.

Second, some investors are arguing the US's adversarial push for global economic hegemony is leading a powerful cabal of emerging market nations like China and Russia to once again buy gold in a bid to alleviate the stranglehold of the US dollar as the world's reserve currency. Whether or not this theory holds water it seems likely that as currency wars increase gold comes back in favour with central governments.

Third, on the topic of currency wars the US administration's trade war has set central banks off globally in a race to the bottom type scenario in cutting national cash lending rates.

This is because central bankers and elected governments are scared a tariff or trade war will hurt their exports, with the antidote being cash rate cuts to increase competitiveness.

The cuts of course also serve to stimulate internal demand, with U.S. President Trump egging the Federal Reserve to cut US rates on an almost daily basis.

The point is that lower risk free, benchmark debt, or cash rates benefit gold as an asset class as its lack of income becomes less of a problem, while its role as a store of value becomes more attractive.

Finally, it's worth noting that if the Australian dollar keeps falling local gold miners' profit margins should grow as most of their mining costs are incurred in Australian dollars before they sell their product in US dollars.

All this is why I've suggested multiple times over 2019 that gold is likely to go higher and that ASX gold miners represent a potential way to profit from this.

Even though I remain bullish on gold on the fundamentals over say the next 18 months, I'm unlikely to buy gold shares myself as I expect there are still better risk-adjusted returns elsewhere.