The Nearmap Ltd (ASX: NEA) share price is down around 15% since it reported a widening net loss of $14.9 million on revenue of $77.6 million last Wednesday. The rising losses are on the back of increased investment costs in sales and marketing efforts in the vast US market where it managed annualised contract value (ACV) growth of 76% to US$22.7 million over the year.

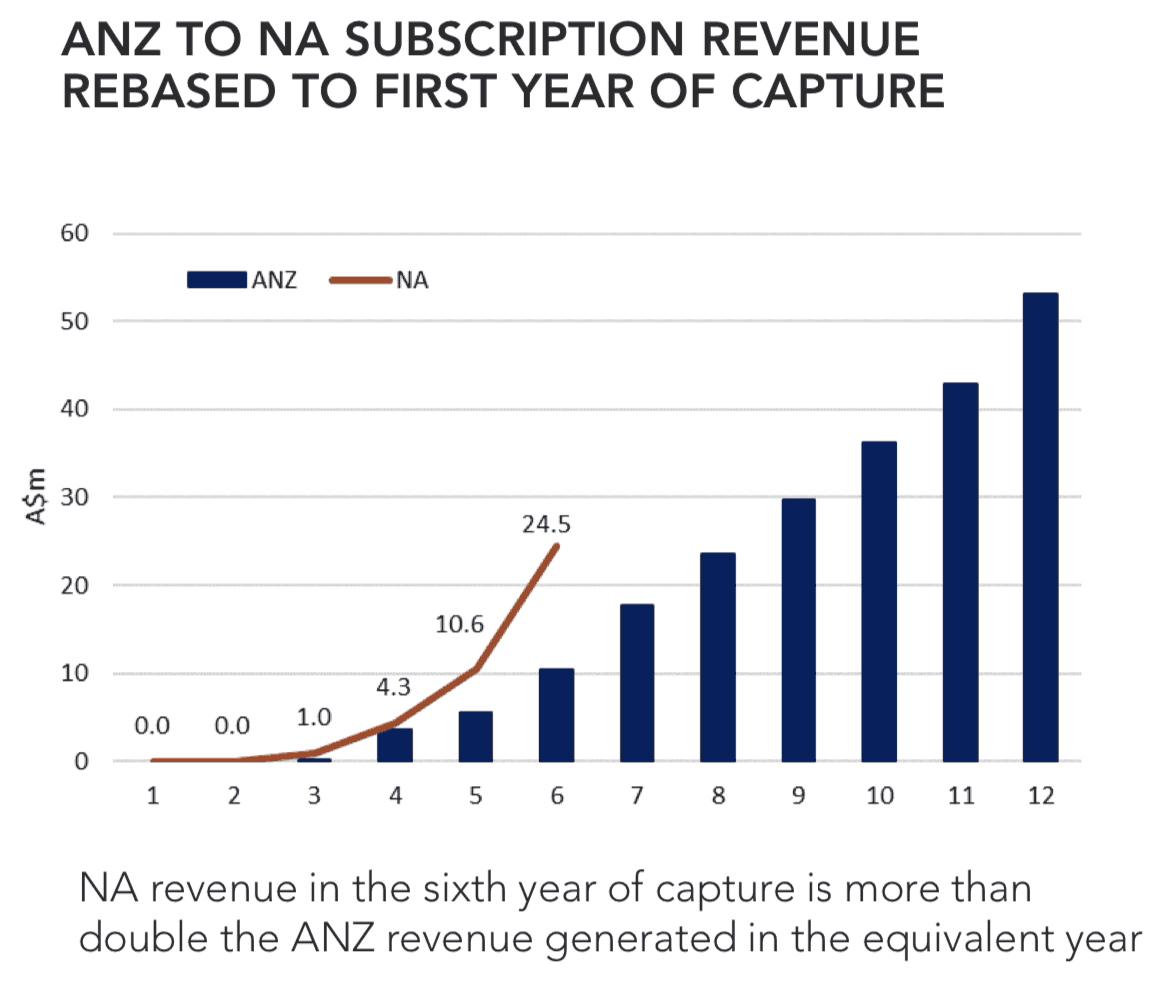

FX-adjusted US ACV now represents over one third of the group total of A$90.2 million and Nearmap has grown in the US market far quicker than it did in ANZ. The chart below shows this.

Source: Nearmap presentation, Aug 21, 2019.

Nearmap's ANZ business posted a net operating cash inflow of $32.5 million on revenue of $53.17 million for fiscal 2019, so we can see that if the US business continues on a similar growth trajectory it's likely to be highly profitable itself in a couple of years time.

However, I'd caution investors not to extrapolate too much from the chart above or 'bet the house' on Nearmap rocketing as further progress in the U.S. market is far from guaranteed.

More importantly Nearmap has invested heavily in new product and technology to support its competitive position in the U.S. and to up-sell new products to customers globally.

It now offers 3D mapping, and will soon offer more comprehensive AI and data analytic tools to help users get even more value out of the product.

You can't get something for nothing in the tech space and given how impressive its new tech mapping tools look I expect the increased investment should pay off over the medium term.

In particular if it can reduce churn and raise average revenue per user on the back of investments that would be two key steps of progress alongside its sales ambitions.

After all if Nearmap is genuinely ambitious to grow into a far bigger global business it needs to invest heavily today to support the big returns of tomorrow.

Fortunately after a recent capital raising it has $75.9 million cash on hand with its ANZ group's profits effectively able to self fund losses in the US for now.

The balance sheet strength also leaves it plenty of room to invest to grow into Canada and elsewhere globally, or on new tech initiatives. It should also mean the group does not have to go back to the market again for more cash if management execute's on its strategy.

According to financial news wires the sell side research analysts at Citi remain bullish on the group's outlook and even lifted their share price target to $4.59 after the full year results.

If Citi is on the money Nearmap shares have some 73% upside over the 12 months ahead. At $2.67 this afternoon I'd also rate Nearmap shares a spec buy.

Other growing businesses in the software-as-a-service space investors might want to consider include Catapult Group Ltd (ASX: CAT) and Infomedia Limited (ASX: IFM).