Ever since its 2018 initial public offering the Telix Pharmaceuticals Ltd (ASX: TLX) share price has been on a tear as investors buy into its mission to treat brain, kidney and prostate cancers via targeted molecular radiation therapy.

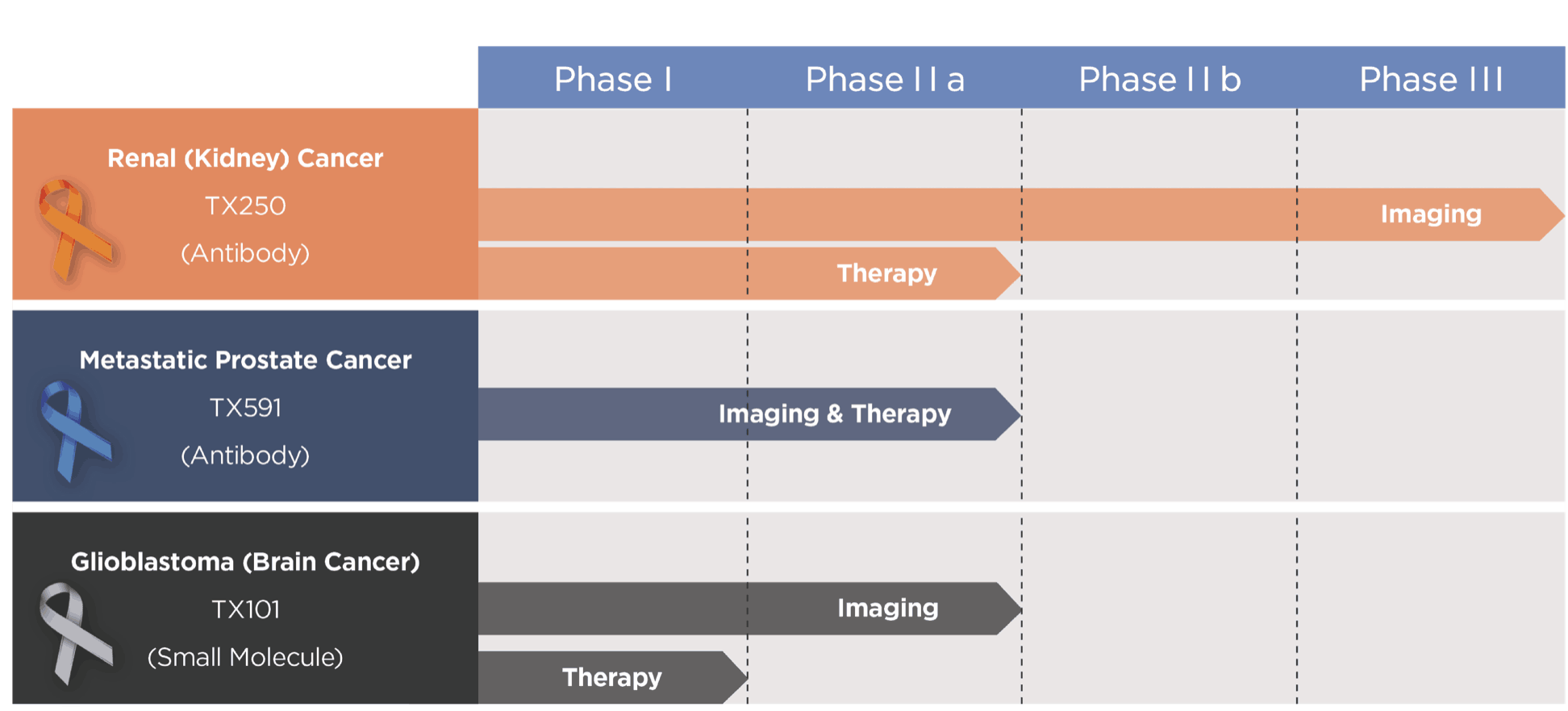

Below is a snapshot of where its current research programs sit in terms of clinical advancement.

Source: Telix website, Aug 1, 2019.

We can see its most advanced program is an agent for imaging renal cancer to meet what it describes as a a "major unmet need in the diagnosis and staging of kidney cancer."

In terms of research early-stage Phase I or II trials generally involve testing a drug or treatments for safety, before complex, large and expensive final Phase III trials are designed usually to meet the onerous demands and standards of healthcare regulators if a biotech is serious about having its product approved.

As such if a biotech's phase III trials can meet their clinical endpoint the company may be on to some commercial success.

Telix does already have one one product branded in the US as illumet for the preparation of imaging of metastatic prostate cancer, which produced total sales of $942,000 for the quarter ending June 30 2019.

However, the group still posted an operating cash loss of around $7 million when you back out government grants and tax incentives of $9.2 million. It had $19.4 million cash on hand as at June 30, 2019.

Today it also announced it has entered into research agreements with European pharmaceutical giant Merck.

It also has the option to try to partner with 'big pharma' down the line in order to share the costs and benefits of potentially trying to get any of its clinical treatments commercially approved.

Other speccy biotechs that might be worth a look for investors include Next Science Ltd (ASX: NXS) and Paradigm Pharmaceuticals Ltd (ASX: PAR).