In morning trade the Netwealth Group Ltd (ASX: NWL) share price has pushed higher following the release of its latest quarterly business update.

At the time of writing the investment platform provider's shares are up over 4% to $7.70.

What was in Netwealth's update?

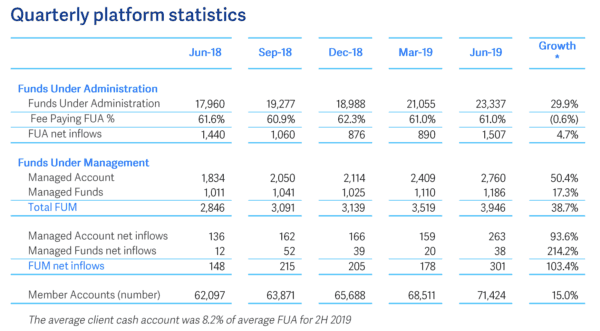

According to the release, during the quarter the company's funds under administration (FUA) increased $2.3 billion or 10.8% quarter on quarter to $23.3 billion. This means the company achieved a $5.4 billion or 29.9% increase for the full year.

The release explains that it achieved FUA net inflows of $1.5 billion in the June quarter, with the remaining $0.8 billion increase due to favourable market movements. Total FY 2019 FUA net inflows came in at $4.3 billion.

On the table below, you can see how the company has progressed over the last 12 months.

The solid growth in FUA this year means that Netwealth has grown its market share from 2.3% to 2.5%.

This makes it the ninth-largest platform provider (in FUA terms) behind the likes of IOOF Holdings Limited (ASX: IFL), AMP Limited (ASX: AMP), and the market leader Westpac Banking Corp (ASX: WBC) through its BT business.

But whilst it may trail these competitors in total FUA, its net funds flows increase of $4.3 billion over the 12 months to March 31 was the biggest in the industry by a decent margin.

The next best performers over the same period were HUB24 Ltd (ASX: HUB) with a $3.7 billion increase and then Macquarie Group Ltd (ASX: MQG) with a $1.9 billion lift in platform FUA.

And with the company launching Challenger Ltd (ASX: CGF) annuities on its platform last month and its platform continuing to grow in popularity and rate highly with users, management appears confident that its solid growth can continue at the expense of some of the bigger players which continue to give up market share.