The Sonic Healthcare Limited (ASX: SHL) share price rose 0.1% this morning, but if you've been thinking of buying shares in the global laboratory medicine company for its growing divided, there are a few things you need to know today.

The first is that shares will go ex-dividend on Friday, March 8, 2019. The 'ex-date' is when the shares start selling without the value of its next dividend payment so an investor needs to own the shares before the ex-date to receive the dividend. The dividend will then be paid on Tuesday, March 26, 2019.

What is Sonic Healthcare' dividend yield?

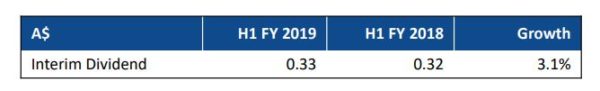

At its recent half-year results, Sonic Healthcare declared an interim dividend of 33 cents per share (cps) for the six months. This was up 3.1% on the same period last year and gives Sonic Healthcare a trailing dividend yield of 3.4%, partially franked.

Source: Sonic Healthcare Limited 1H19 Presentation

Is the dividend sustainable going forward?

Sonic Healthcare offers what is known as a 'progressive' dividend policy which means the dividend rises over time as earnings per share increase and, in theory, will simply be held flat if the company has an off-year and earnings fall.

This policy works best for companies with steady growth pathways and Sonic Healthcare appears a reasonable fit, with earnings per share up 17.5% over the four years to 2018, though not in a straight line.

Based on the company's recent guidance the policy should continue to work well. The company notes it is "well set for ongoing strong growth" with estimates of Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) growth of 6%-8% for the full 2019 financial year.

It was a positive update for investors, however, if you're looking for faster earnings growth there are two other dividend-paying tech companies going ex-dividend on 08 March to consider:

- Vista Group International Ltd (ASX: VGL)

- WiseTech Global Ltd (ASX: WTC)