The WiseTech Global Ltd (ASX: WTC) share price rose 2.4% yesterday, but if you've been thinking of buying shares in the global software player for its growing, fully franked divided, there are a few things you need to know today.

The first is that shares will go ex-dividend on Friday, March 8, 2019. The 'ex-date' is when the shares start selling without the value of its next dividend payment so an investor needs to own the shares before the ex-date to receive the dividend. The dividend will then be paid on Friday, April 5, 2019.

What is WiseTech Global Ltd's dividend yield?

At its recent half-year results, WiseTech declared an interim dividend of 1.5 cents per share (cps) for the six months. This was up 43% on the same period last year and gives WiseTech shares a trailing dividend yield of 0.15%, fully franked.

The dividend represents a payout ratio of about 20% so, sure, if you're looking for regular income today WiseTech probably isn't going to do it for you.

WiseTech is very much a growth story so the vast majority of earnings are being injected back into the business to fuel growth, rather than showering investors with cash.

Is the dividend sustainable going forward?

The good news is, well yes, given the high rates of growth that WiseTech is achieving it is highly likely that the dividend will be not only sustained but continue to grow in the years ahead.

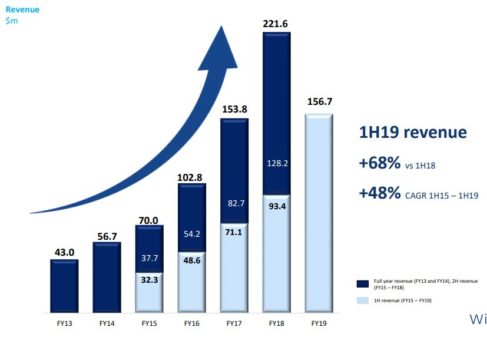

At the company's half-year update last month WiseTech presented revenue growth of 68% and Net profit after tax (NPAT) growth of 48% for the six months to 31 December 2018 and provided guidance of full-year revenue growth of between 45% to 51%.

Source: WiseTech 1H19 Presentation

It was a strong update and sets up nicely the prospect of an increasing dividend, even if the payout ratio stays unchanged.

However, if you're looking for a bit more bang for your buck today, there are also several other companies going ex-dividend on 8 March to consider, including: