The Rio Tinto Limited (ASX: RIO) share price dropped 0.8% yesterday, but if you've been thinking of buying shares in the global commodity titan for chunky, fully franked divided, there are a few things you need to know today.

The first is that shares will go ex-dividend on Thursday March 7, 2019. The 'ex-date' is when the shares start selling without the value of its next dividend payment so an investor needs to own the shares before the ex-date to receive the dividend. The dividend will then be paid on Thursday April 18, 2019.

What is Rio Tinto Limited's dividend yield?

At its recent half-year results, Rio Tinto declared a final dividend of $2.51 per share for the 2018 year. This was up 9.8% on the same period last year and, setting aside the additional $3.39 special dividend which was also announced, at the current share price of $95.61, Rio Tinto offers a trailing dividend yield of 4.4%, fully franked.

Is the dividend sustainable going forward?

This is a great question to ask before buying any company for its dividend.

At the company's full-year update last month Rio Tinto presented Net profit after tax (NPAT) of US$13.6 billion for the year to 31 December 2018, up a massive 56% on the 2017 financial year.

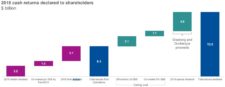

Like BHP Group Ltd (ASX: BHP), Rio Tinto has had a strong focus on returning capital to investors over the last 12 months and the strong result helped the company to return US$13.5 billion to shareholders through dividends and share buy-backs. The total dividend (excluding the special dividend) of $4.21 per share was the largest in the company's history.

Source: Rio Tinto 2019 results presentation

This could be hard to top heading into the 2019 financial year, with Chairman Simon Thompson noting "we face considerable geopolitical uncertainties, particularly in relation to trade, and can expect a year of volatile commodity prices".

That said, Rio Tinto has a surprisingly strong history of dividend growth given the lumpy nature of commodity prices.

There are also several other companies going ex-dividend on 07 March to consider, including:

- Corporate Travel Management Ltd (ASX: CTD)

- QBE Insurance Group Ltd (ASX: QBE)

- BHP Group Ltd (ASX: BHP)