The BHP Group Ltd (ASX: BHP) share price has dropped 1% this morning, but if you've been thinking of buying shares in the global commodity titan for its chunky, fully franked divided, there are a few things you need to know today.

The first is that shares will go ex-dividend on Thursday March 7, 2019. This is the date when shares start selling without the value of its next dividend payment.

An investor needs to own the shares before the ex-date to receive the dividend which will be paid on Tuesday March 26, 2019.

What is BHP Group Ltd's dividend yield?

At its recent half-year results, BHP Group declared a dividend of US$0.55 per share for the half year. This was flat on the same period in 2018 and, setting aside the additional US$1.02 per share special dividend paid in January 2019, at the current share price BHP shares offer a trailing dividend yield of 4.4%, fully franked.

Source: BHP Group 1H19 Presentation

Is the dividend sustainable going forward?

This is a great question to ask before buying any company for its dividend.

At the company's half-year update last month BHP presented Net profit after tax (NPAT) of US$3.8 billion for the six months to 31 December 2018, up 87% on the same period in 2017.

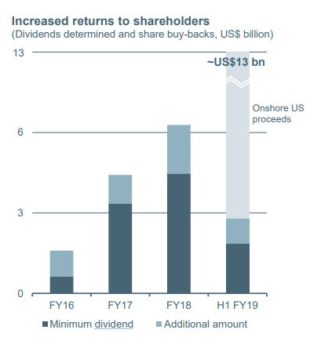

BHP has a target dividend payout ratio of at least 50% of "underlying attributable profit", but has had a strong focus on returning capital to investors over the last 12 months, including the special dividend payment and completion of a US$5.2 billion share buy-back after the sale of its Onshore US oil and gas assets last year.

Foolish takeaway

In isolation, the current dividend looks reasonably attractive, especially if you factor in the recent special dividend. However special dividends are lumpy and commodity producers, in general, are often prone to cyclical earnings fluctuations which can make dividends unpredictable. For this reason, BHP Group wouldn't make my list of 'top dividend' stocks to own today.

Fortunately, there are several other big companies going ex-dividend on 07 March to consider, including: