This morning Corporate Travel Management Ltd (ASX: CTD) reported its half-year results for the period ending December 31 2018. Below is a summary of the results with comparisons to the prior corresponding half.

- Revenue and other income of $212.2m, up 23%

- Underlying (excluding some one-off and tax costs of $1.4m) EBITDA of $64.6m, up 21%

- Statutory net profit of $38.9m, up 27%

- Adjusted net profit (excluding acquisition amortisation) of $42.6m, up 20%

- Statutory earnings per share (EPS) 36 cents, up 25%

- Underlying EPS 39.4 cents, up 17%

- Half year dividend 18 cents, up 20%

- Trading at top end of guidance for full year EBITDA at $150m, up 20% on prior fiscal year

This is another strong result for a founder-led business that has grown its stock price from $1.64 in mid-February 2011 to $26.30 today thanks to an organic and acquisitive growth strategy.

On the headline numbers all four of the group's operating regions of ANZ, North America, Asia and Europe (UK) performed well posting adjusted EBITDA (operating income) growth between 15% and 34% over the half on the back of market share and new client wins.

The group's historical success has come about as its product suite lets clients save money and a little time by outsourcing their travel booking needs to a player such as Corporate Travel that has more bargaining power with the airlines over pricing among other benefits.

Investors should also note running corporate travel agencies is a sales game where staff are incentivised to win new clients and therefore earn more commission for themselves.

This has been an effective business model since the start of capitalism and aligns many of its 2,700 staff members' interests with the company and shareholders.

Corporate Travel's success then has come about via heavy alignment of staff's interest and a smart roll-up or acquisition strategy that has seen it build out into North America, Asia and Europe.

Importantly, the roll-up strategy has been done without debt or the share count ballooning (bank borrowings at $61 million), while EPS grew 17% to 39.4 cents over the half.

Of course at the end of 2018 the group was attacked by a little-known hedge fund (VGI) that has bet huge sums over the past few years on the share price falling with no luck and is likely nursing huge mark-to-market losses for now.

Much of VGI's short thesis has been around revenue recognition, working capital management, cash flows and balances, although this morning the company moved again to dismiss the allegations in line with what auditor Ernst and Young also recently concluded.

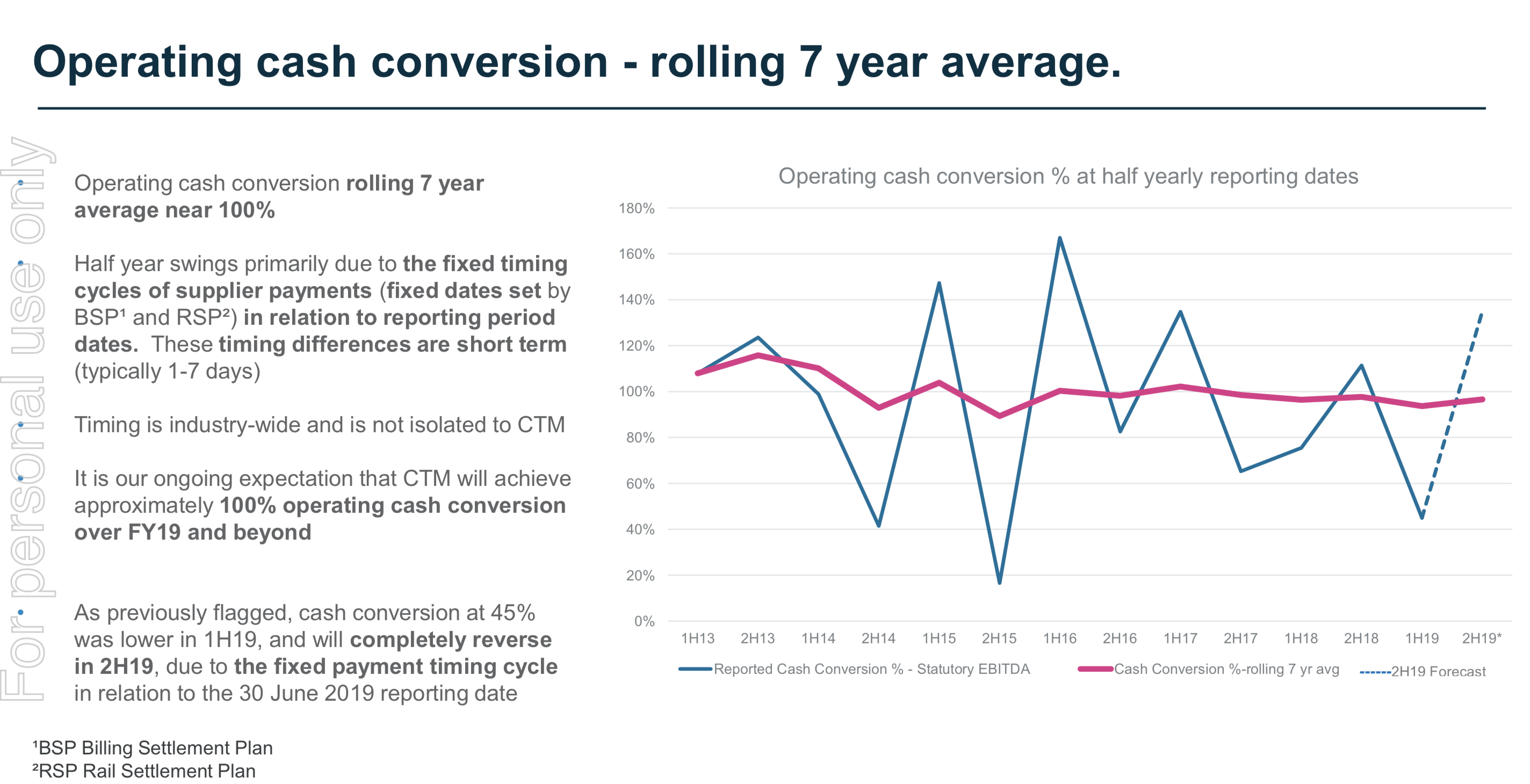

Admittedly cash flow for the first half of fiscal 2019 looks weak, but Corporate Travel provided a chart below to explain why revenue recognition and cash flows in the corporate travel services industry commonly mismatch.

In simple terms the chart below shows how the timing of payments to and from suppliers (airlines, etc) and clients varies, although operating cash conversion always reverts close to 100%.

The purple line below shows how operating cash conversion on a rolling 7-year average has always tracked close to 100%.

At the end of the day the market will follow the cash flow and given the strong growth it's no surprise the stock is up 15% to $29 this morning.

Other companies still to hand in profit report cards this February to watch include Flight Centre Travel Group Ltd (ASX: FLT) and Webjet Limited (ASX: WEB).