There is no doubt the concept of "FIRE" – financially independent and retired early – is catching on. With millennials and the older generations alike looking for more out life than being chained to a desk, many are looking for ways to build a solid nest that gives them the freedom to live their best life.

In my view, the key to achieving financial independence is the basics of investment – good fundamentals and the magic of compounding returns.

The long and the short of dividends

Many investors are blinded by short-term gains, but those who really know their finance understand that investing is a long-term game. Buying and selling on tactical investments is fine for that quick buck, but Fools would know that transaction costs, taxes and those microcap punts that just didn't take off can all eat into profits.

I like to invest in companies or index funds that offer dividend reinvestment programs (DRPs). DRPs allow investors to receive the juicy yield on offer with the likes of National Australia Bank Ltd. (ASX: NAB) or Alumina Limited (ASX: AWC) but rather than receiving the cash, they can reinvest those dividends into more shares of the stock.

But aren't I losing out on realised returns?

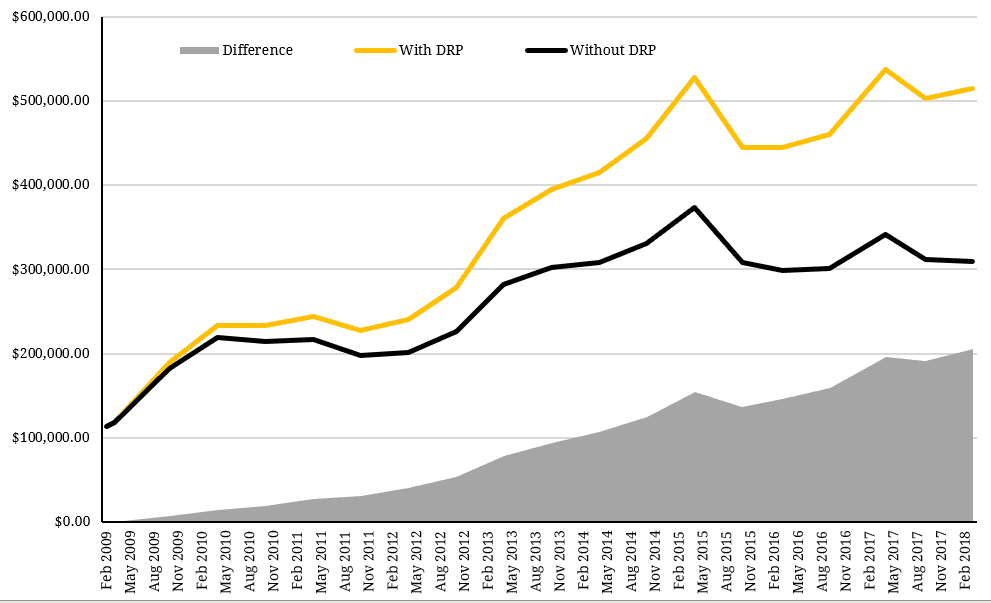

Well, history would suggest not – in fact, you'd be losing out if you took the cash dividend. I've taken a simple example below by using one of Australia's largest companies – the Commonwealth Bank of Australia (ASX: CBA). What you'll see in the charts is that over the last 10 years, starting from February 2009, if you had bought 100 shares in CBA and taken the cash dividends, your total return would be an impressive 151%.

Not bad for a position I just said was a bad decision, hey? Well, let's take a look at how another investor would have fared had they held the same 100 shares in CBA but instead reinvested their dividends over that same 10-year period.

CBA Total Return from 2009-2019 (DRP vs No DRP)

That investor would have realised a whopping 328% return on their initial investment – meaning 4,000 shares in CBA in 2009 would now be worth over $500,000 today.

Now, I'm no numbers guy, but I think I'd take 328% over the initial fun money from the cash dividend on offer. And this example holds for the majority of stocks, which is why I jump at the chance to sign up for DRPs when they're on offer to maximise my future returns.

Are there other benefits?

This process could also help me minimise tax, with all that upside appreciation becoming capital gains once I'm retired and on a lower tax base, rather than income at my marginal tax rate. The other beauty of this is that once you hit your early retirement or "FIRE" goal, you can simply unsubscribe from the DRP and begin living off the dividends – a double win!