This week Westpac Banking Corp (ASX: WBC), Suncorp Group Ltd (ASX: SUN) and Bendigo and Adelaide Bank Ltd (ASX: BEN) subsidiary Adelaide Bank announced plans to lift the rates on home loans out of cycle with the Reserve Bank.

The rest of the major banks are widely expected to follow suit in the coming days or weeks as they look to combat funding pressures.

One unlikely company that is coming to the rescue of homeowners is the fast-growing Kogan.com Ltd (ASX: KGN).

According to an announcement made after the market closed on Friday, the ecommerce company has entered into multi-year agreements with Adelaide Bank and Pepper Group to offer competitive home loan products to Australian homeowners and investors under a new brand, Kogan Money.

Kogan Money Home Loans is expected to launch in FY 2019 and will be the first suite of financial products and services rolled out under the Kogan Money brand.

Management advised that it aims to focus on simplifying credit and financial services for all Australians and making them more affordable through digital efficiency.

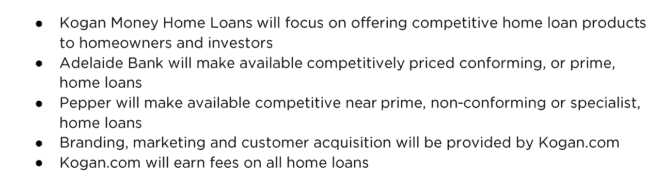

Key details include:

No information has been provided in respect to rates, but management intends to provide details of its offering closer to the launch date. Though, judging by the way the company operates, I feel it is quite likely that Kogan Money will look to undercut the banks at a time when they are raising rates. This could make the company's offering quite attractive to home owners.

Should you invest?

While I think it is a little too soon to make an investment decision based purely on this development, I already felt that Kogan's shares were in the buy zone, so this expansion merely sweetens the deal.

I suspect the market may respond positively to the news when it opens for business again on Monday.