The Harvey Norman Holdings Limited (ASX: HVN) share price has fallen over 2.5% to $3.67 in early trade following the release of the retailer's full year results.

For the 12 months ended June 30, here is how Harvey Norman performed compared to a year earlier:

- Company-operated sales revenue up 8.8% to $1,993.76 million.

- Franchise aggregated headline sales revenue up 2.6% to $5,760 million.

- EBITDIA fell 7.2% to $707.7 million.

- EBIT down 15.7% to $556.5 million.

- Underlying profit after tax and NCI dropped 0.1% lower to $377 million.

- Basic earnings per share of 33.7 cents.

- Full year dividend of 30 cents per share.

- Outlook: Growth will mainly be in South East Asia.

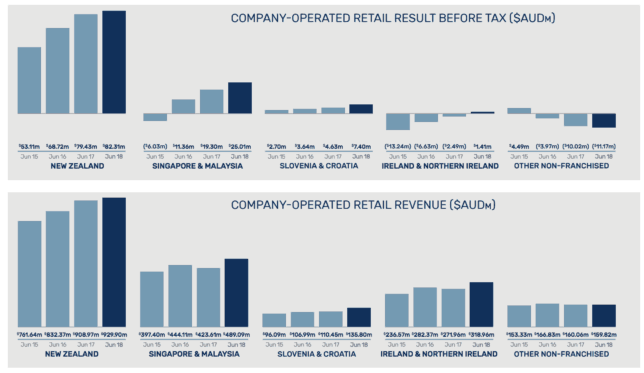

As was largely expected, Harvey Norman delivered a soft result in FY 2018. This was despite a strong performance from its company-operated offshore retail operations. As shown below, its company-operated offshore retail operations performed well across the board and grew profit by 15.1% to $116.1 million.

This strong form was offset by weakness in its Franchising Operations segment. Segment profit fell 7.2% to $282.5 million in FY 2018 due to a combination of lower franchise fees received and higher tactical support to protect, promote and enhance the brands, in addition to a rise in other costs to operate the segment.

The company also reported a 1.8% decline in profit from property segments (excluding net property revaluations) to $136.92 million. The small decline was primarily due to increased borrowing costs for acquisition and the refurbishment of property assets.

Outlook.

Management continues to focus on flagship stores strategy which has performed above expectations thus far. In the first half the company intends to launch a flagship store in eight countries.

However, it expects the main source of growth in FY 2019 will come from South East Asia with the expectation of opening 9 new stores in Malaysia over the next two years.

Should you invest?

I didn't see anything in today's results to make me want to buy Harvey Norman's shares. In light of this, it remains on my avoid list along with industry peer JB Hi-Fi Limited (ASX: JBH).

Investors wanting exposure to the retail sector might be better off considering retailers such as Accent Group Ltd (ASX: AX1), Noni B Limited (ASX: NBL), or Specialty Fashion Group Ltd (ASX: SFH).