It has been a positive day of trade for the Amaysim Australia Ltd (ASX: AYS) share price following the release of its full year results.

At one stage the telco company's shares were up as much as 8.5% to $1.14 before giving back some of these early gains. At the time of writing Amaysim's shares are 4% higher at $1.09.

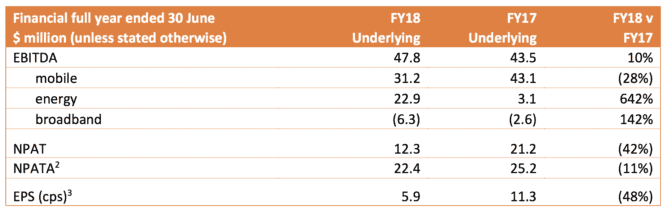

Here is a summary of how it performed in FY 2018 compared to a year earlier:

- Statutory net revenue increased 76.8% to $577.6 million.

- Statutory EBITDA up 11% to $37.6 million. Underlying EBITDA up 9.8% to $47.8 million.

- Underlying NPATA down 11.2% to $22.4 million.

- Earnings per share of 5.9 cents.

- Mobile subscribers increased 7.8% to 1.158 million.

- Mobile average revenue per user (ARPU) fell 20.4% to $17.87.

Although this was clearly a weak result after a tough 12 months, the market had been bracing itself for a sizeable decline in profits after it disastrous first half.

Pleasingly, a better than expected performance from its Mobile segment meant that this result was actually slightly better than many had been predicting. I suspect this is why its shares rallied higher today.

A note out of Goldman Sachs shows that Amaysim's Mobile EBITDA came in 8% higher than it forecast due to a less severe drop in ARPU than predicted. The company's results were also lifted by a solid performance from its Energy segment, as shown below. The latter was driven by a 15.9% increase in energy subscribers to 191,000. The company's Broadband business continued to grow in FY 2018, ending it with approximately 15,000 subscribers. It delivered statutory net revenue of $8.6 million but an underlying EBITDA loss of $6.3 million.

Outlook.

Management has stopped short of providing any real guidance for FY 2019. Instead, it has stated that it believes there are opportunities in FY 2019 and expects underlying EBITDA to reflect continued earnings growth in energy, competition to continue to put pressure on mobile ARPU and margins, a reduction in underlying operating costs driven by the simplification of its structure and a more disciplined approach to cost management, and the discontinuation of devices.

Should you invest?

At 19x earnings I don't see a great deal of value in Amaysim's shares right now. Especially if its growth is limited due to the increasingly competitive trading conditions that all three of its segments face.

In light of this, I would class it as a hold along with telco rivals Telstra Corporation Ltd (ASX: TLS) and TPG Telecom Ltd (ASX: TPM).