The Altium Limited (ASX: ALU) share price will be on watch on Wednesday after the electronic design software company released its full-year results after the market close.

For the 12 months ended June 30, Altium achieved revenue growth of 26% to US$140.2 million and a 34% increase in net profit after tax to US$37.5 million. While this is a slowdown from revenue growth of 30% and profit growth of 51% in the first-half, its profit result sits just a touch higher than the Bloomberg consensus estimate of US$37.4 million. This strong profit growth led to earnings per share of 28.8 U.S. cents (39.19 Australian cents) and allowed the board to declare a final dividend of 14 Australian cents per share. This brought its full year dividend up 17% to 27 Australian cents.

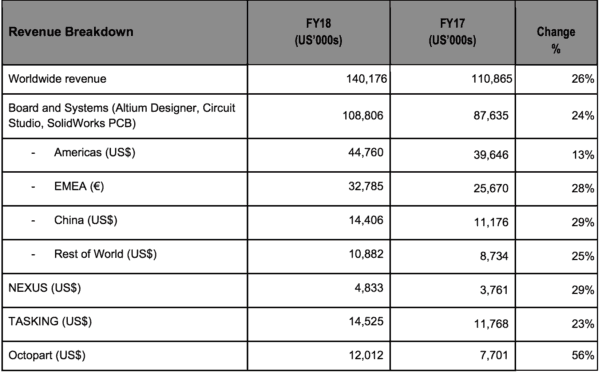

One key driver of growth this year was its Board and Systems segment. As you can see below, revenue from the segment grew 24% to US$108.8 million thanks to growth in all regions. The Americas remains the biggest contributor to revenue in the segment, growing 13% to US$44.8 million during the year. Not too far behind was the EMEA region which delivered a 28% increase in revenue to 32.8 million Euros. Complementing this was the China region which was a highlight and grew 29% to US$14.4 million and the Rest of the World which delivered a 25% increase in revenue to US$10.9 million.

There were also strong performances from its NEXUS, TASKING, and Octopart businesses. Octopart in particular was a star performer with its 56% jump in revenue to US$12 million. Octopart delivers part level intelligence to the electronic design engineering community and management believes it is quickly establishing itself as the number one brand associated with electronic parts search.

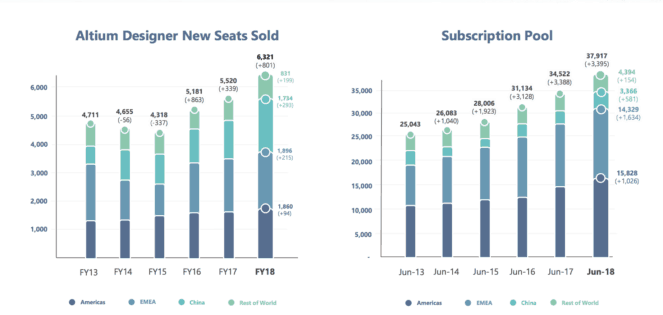

Another highlight in FY 2018 was the growth of its subscription pool for recurring revenue, shown above. This increased by 10% during the period to reach over 37,900 subscribers. Management stated that this current run rate of growth in the subscription pool is consistent with what is required to achieve its 2020 financial goals. It remains confident that it will achieve its 2020 targets of US$200 million revenue and EBITDA margin of 35% or better. Its EBITDA margin in FY 2018 was 32%, up from 30% a year earlier.

Beyond 2020 the company is targeting 100,000 active subscribers of its flagship product, Altium Designer, before 2025. Management believes that achieving this will compel key stakeholders within the manufacturing and supply chain industry to support its agenda to transform electronic design and its realisation.

And given the fact that some of the biggest companies in the world (shown above) are users of Altium's software, I feel this target is more than achievable.

Should you invest?

I believe this strong result demonstrated why Altium is regarded as one of the best tech shares on the local market alongside Appen Ltd (ASX: APX) and WiseTech Global Ltd (ASX: WTC).

However, its shares are a little on the expensive side at 56x earnings, so it may be prudent to wait for a pullback to try and get in at a better price if one comes. Though it is worth noting that Altium has a habit of taking off and not looking back. I've learnt this the hard way in the past.