Warren Buffett, the world's greatest investor, says that his favourite holding period is forever.

It certainly makes a lot of sense to hold forever. No brokerage costs, no taxes on capital gains, no need to make as many investment decisions.

However, it only makes sense to hold shares of a particular business forever if that business is going to be economically viable forever as well.

With that question in mind, here are three shares I plan on holding forever:

Rural Funds Group (ASX: RFF)

Rural Funds Group is a real estate investment trust (REIT) that invests purely in agricultural property and leases those properties to high-quality tenants.

Humans have been utilising farmland for thousands of years, some estimates put it at over 12,000 years. There's an extremely high likelihood that farmland will be a valuable (and growing) asset for at least the next century – being every reader's lifetime.

Rural Funds owns farmland in a variety of food sectors including cotton, cattle, poultry, macadamias, almonds and vineyards. It may expand to other sectors in time.

Management believe that the REIT can grow its distribution by 4% each year over the long-term. This isn't strong growth, but it will soundly beat cash over the years.

InvoCare Limited (ASX: IVC)

InvoCare is Australia and New Zealand's leading funeral operator with a market share of around a third. The sadly reality is that there are only two things certain in life: death and taxes, as the saying goes.

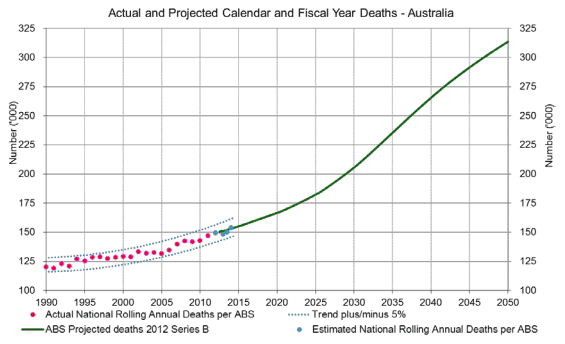

The larger Australia's population becomes the more potential 'customers' InvoCare has. Australia is expected to see a rising death rate for many years to come. Death volumes are expected to grow by 1.4% per annum between 2016 to 2025 and then increase by 2.2% per annum from 2025 to 2050.

This morbid tailwind can be seen on this graph:

InvoCare's current re-investment program should drive organic growth higher for years to come, even if the next couple of reporting seasons are tough.

Washington H Soul Pattinson and Co. Ltd (ASX: SOL)

There are few businesses in Australia that have been around as long as Soul Patts, it has been listed on the ASX since 1903. The company has never failed to pay a dividend to shareholders during this time.

Soul Patts is an investment conglomerate, meaning that it invests into businesses it thinks are long-term opportunities and holds large stakes. Being an investment business means it is flexible and adaptable – it can change its holdings to suit the times.

Five generations of the Pattinson family have served the company, as have three generations of the Dixson, Spence, Rowe and Letters families. More than 40 employees have worked for the company for over 50 years. This long-term employment approach with management and employees means the business itself can take a long-term approach. This has led to market-beating returns over the years.

Foolish takeaway

All three businesses have great buy-and-hold-forever potential. I own shares of all three in my portfolio and want to buy a lot more of them over the coming years. Rural Funds looks quite attractive for the income today, whilst InvoCare could become cheaper after its report this month. Soul Patts is too expensive for me to consider buying today.