The dramatic drop in the Australian dollar has put the focus on stocks best leveraged to the greenback as these stocks are expected to enjoy an earnings boost when they convert their US-dollar sales back into Aussie.

But a handful of these US-dollar earners are likely to enjoy another tailwind when they announce their next profit results later this year.

This added profit booster is sponsored by the US taxpayer following President Donald Trump's corporate tax cut, although some ASX companies with US operations stand to benefit more from this than others.

Trump's tax cut is the most significant change to the US tax system in more than three decades and UBS estimates that it will add around $400 million to FY19 earnings of companies in the S&P/ASX 100 (Index:^ATIO) (ASX:XTO).

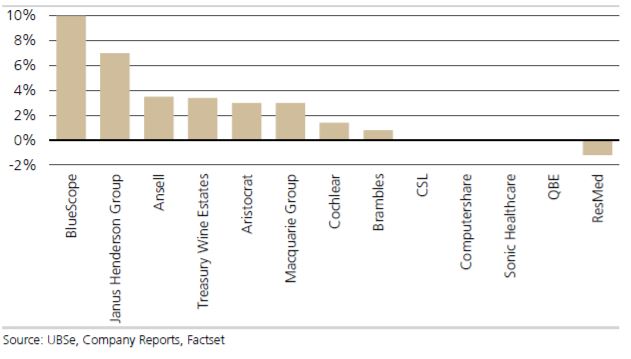

The broker believes that the biggest beneficiary from the US tax cut is steel products maker BlueScope Steel Limited (ASX: BSL) as its FY19 earnings per share (EPS) will jump by 10% due to a drop in its effective tax rate to 18.7% from 28.7%.

Less Taxing Times: Best and worst winners from Trump's tax cuts

This is followed by wealth management group JANUS/IDR UNRESTR (ASX: JHG), more popularly known as Janus Henderson. UBS is forecasting a 7% uplift to its FY19 EPS as its effective tax rate drops 7 percentage points to 22%.

However, there are a number of blue-chips with large US market exposure who will receive little or no benefit from the tax cut, although their bottom-lines will probably still enjoy an uplift from the exchange rate.

Insurer QBE Insurance Group Ltd (ASX: QBE) is one such example as the group has significant deferred tax assets on its balance sheet and isn't expected to pay US taxes in the next financial year.

Don't get your hopes up for blood plasma company CSL Limited (ASX: CSL) either even though the US makes up for around half of its revenue as its tax base is in Switzerland, while medical facilities operator Sonic Healthcare Limited (ASX: SHL) only has a small presence in the US and won't reap much benefit from the reduction in the tax rate.

Meanwhile, Trump's cut to the headline corporate tax rate is a double-edged sword to some companies as it removed a number of tax concessions and loopholes. This has effectively removed any tax benefit to share registry services company Computershare Limited (ASX: CPU), explained UBS.

On the other end of the scale, RESMED/IDR UNRESTR (ASX: RMD), better known as ResMed, is facing an earnings drag from the tax changes as UBS believes that any tax cut benefit will be more than offset by the other adjustments to US tax rules and changes to the Australian tax code to limit the shifting of profits to countries with more favourable tax treatments.

However, don't get too hung up on the tax winners and losers. UBS found little evidence that companies with a tax advantage actually outperform the market.

Changes to the exchange rate has a greater influence on share price performance, in my opinion.

But US-dollar earners aren't the only ones facing a bright outlook this year. The experts at the Motley Fool have nominated their three best blue-chip stocks for 2018 and you can find out what these stocks are for free by following the link below.