The Woolworths Group Ltd (ASX: WOW) share price will be one to watch on Friday after the retail conglomerate delivered a half-year profit result ahead of the market's expectations.

Key highlights from the half include:

- First-half sales from continuing operations increased 3.8% on the prior corresponding period to $29,807 million.

- Australian Food comparable sales up 4.9% during the half.

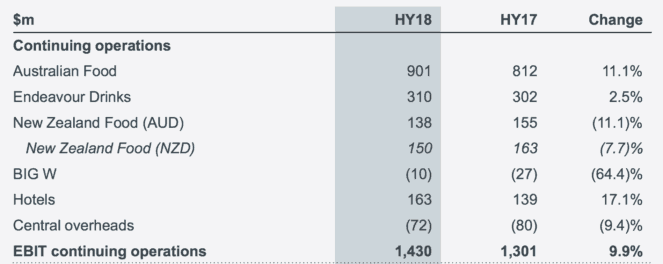

- Earnings before interest and tax (EBIT) rose 9.9% to $1,430 million.

- Net profit after tax (NPAT) from continuing operations rose 14.7% to $902 million. NPAT (including discontinued petrol operations) of $969 million, up 37.6%.

- Basic earnings per share of 69.7 cents.

- Interim dividend increased 26.5% to 43 cents per share (fully franked).

The key driver of today's solid result was Woolworths' Australian Food business. Thanks to a 4.9% increase in comparable store sales, the segment posted an 11.1% lift in EBIT to $901 million.

As you can see below, supporting this growth was its Endeavour Drinks and Hotels segments.

The same cannot be said for its New Zealand Food segment and the embattled BIG W segment. BIG W continues to be a loss-maker, posting a loss before interest and tax of $10 million. As a contrast, this week rival Kmart, operated by Wesfarmers Ltd (ASX: WES), turned in yet another impressively strong result over the same period.

Outlook.

Things aren't expected to get any better in the second-half for BIG W. Whilst its multi-year turnaround plan is gaining momentum, the brand is expected to post a loss of between $80 million and $120 million for the full-year.

But Australian Food sales could offset this weakness. They have continued to remain positive thus far in the second-half, with Australian Food comparable sales growth of 3.7% for the first seven weeks despite cycling the strong second-half sales recovery in FY 2017.

Should you invest?

I thought this was a very positive result for Woolworths and has gone some way to justifying its strong share price gain over the last four months.

But at 20x trailing earnings I think its shares are fully valued now and that investors would find greater value elsewhere in the market.

While I wouldn't be a seller if I owned its shares, I wouldn't be a buyer unless they came down 10% or so from the last close price.