In morning trade the Sydney Airport Holdings Pty Ltd (ASX: SYD) share price has fallen 1.5% to $6.64 following the release of the airport operator's full-year results for FY 2017.

For the 12 months ended December 31, Sydney Airport delivered an 8.7% increase in revenue to $1,483 million and an 8.3% lift in earnings before interest, tax, depreciation and amortisation (EBITDA) to $1,198.9 million.

Profit after tax came in 9.1% higher at $348.6 million or 15.54 per share, allowing the company to increase its distribution once again. Sydney Airport's full-year distribution was 34.5 cents per share, an 11.3% increase on FY 2016's distribution.

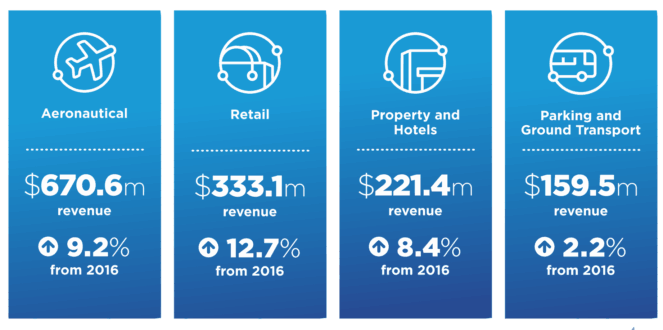

As you can see below, all of Sydney Airport's segments delivered growth in FY 2017, with the key Aeronautical and Retail segments arguably the stand out performers.

The biggest driver of this growth has been a rise in passenger numbers. The number of travellers passing through the airport's gates rose 3.6% in FY 2017 to 43.3 million thanks to a strong rise in visitor numbers from Asia and the Europe and Middle East (EAME) region.

Passenger numbers from Asia (excluding China) increased 6.6% to 5.1 million, passengers from China rose 16.7% to 2.9 million, and EAME passenger numbers increased 10.9% to 2 million.

This increase in passenger numbers also helped its duty free business deliver strong growth, with standout performances in its core liquor, perfume, and cosmetics categories. It also led to increased demand for retail space in its terminals, resulting in all three terminals being fully leased.

The good news is that management appears confident that FY 2018 will be an equally successful year thanks to the solid tailwinds it is experiencing, its strong competitive position, and its overall confidence in the business outlook.

In light of this, it expects to increase its distribution by 8.7% to 37.5 cents per stapled security in FY 2018. Based on its current share price, this equates to a 5.7% forward yield.

Should you invest?

I think that Sydney Airport is one of the better dividend shares on the local share market and one of best ways to gain exposure to the Australian tourism boom along with fellow tourism shares Crown Resorts Ltd (ASX: CWN) and Experience Co Ltd (ASX: EXP).

This could make it worth considering snapping up the company's shares on today's share price weakness.