The Medibank Private Ltd (ASX:MPL) share price rose 3% to $3.12 this morning after the company released its half year results. Here's what you need to know:

- Health insurance revenue grew 2% to $3,175 million

- Medibank Health (services) revenue grew 5% to $292 million

- Net investment income was 15% lower at $68 million

- Net profit after tax grew 6% to $246 million

- Net tangible assets of 51 cents per share, no debt

So what?

It was a reasonable result from Medibank, which lowered its management costs compared to last year as its claims expenses grew slower than revenues. Along with a $5 million gain on the sale of a property, Medibank was able to grow profit by 6% despite sharply lower investment income.

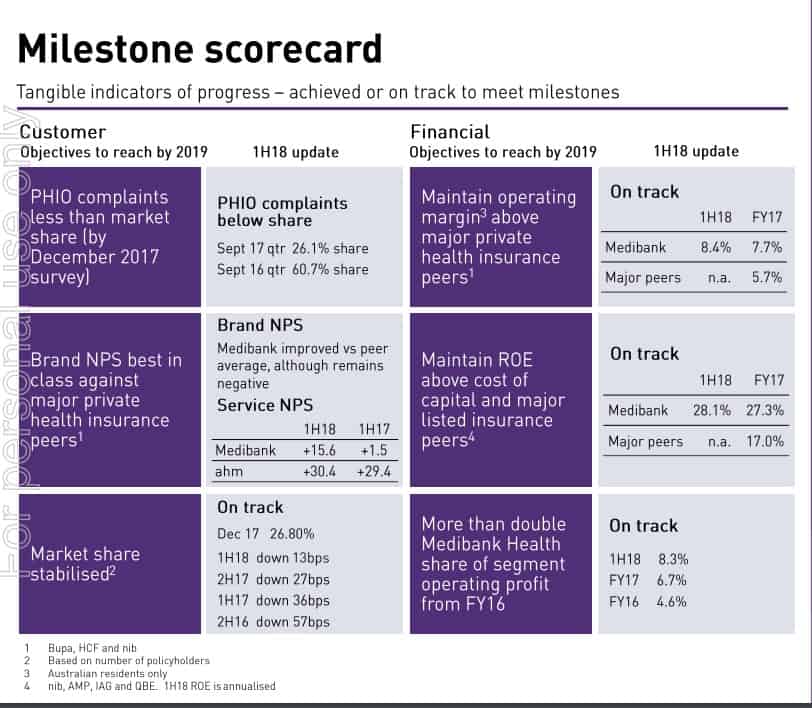

The company has set itself a number of internal objectives, and it is making rapid progress towards achieving them:

It appears as though Medibank has already hit all its goals except for the tricky net promoter score. Private health insurance ombudsman (PHIO) complaints are less than its market share, operating margins are consistently above peers, return on equity (ROE) is well above peers, and the Medibank Health share of operating profit has increased 80%, within reach of management's target of doubling it.

The tricky part will be stemming Medibank's loss of market share. While the decline looks to have slowed somewhat, Medibank's insurance revenue growth of 1.8% is still well below the 4.6% increase in its premiums that it was granted in April 2017 (this half is the first half to bear the full benefit of the higher prices).

I am not sure but I wonder if the slower premium growth also reflects customers switching to the lower cost ahm brand.

Competitor NIB Holdings Limited (ASX: NHF) reports later this month and it will be interesting to see how that company's numbers look compared to Medibank. Judging by these results I would guess that NIB is still growing its market share.

Now what?

Given limited revenue growth, cutting costs will become a more important contributor to profit growth. I would not be overly encouraged by Medibank's lower management expense ratio, this has been lumpy for some time and the company struggles to make any serious headway on it. For example, it was 8.1% in 2015, 8.4% in 2016, and 8.9% in 2017 (all figures from first half results) compared to 8.6% in this half.

Medibank has a good business, but I struggle to see it growing at a reasonable pace and I'm not a buyer of the company at today's price of ~17x estimated full year earnings.