If you are tempted to jump onto iron ore stocks after seeing the recent surge in the share prices of BHP Billion Limited (ASX: BHP), Rio Tinto Limited (ASX: RIO) and Fortescue Metals Group Limited (ASX: FMG), you might be better off waiting a month.

While these stocks have surged ahead over the past month on the improving outlook for iron ore demand and global economic growth, the price of the steel making ingredient is likely to come under pressure in the following few weeks in the lead-up to the Chinese New Year holidays.

Shares in our major iron ore producers may also need to take a break after delivering a stunning rally over the past month. BHP continues to power ahead with a 1.4% gain this morning to $31.18 after posting its first half operating review.

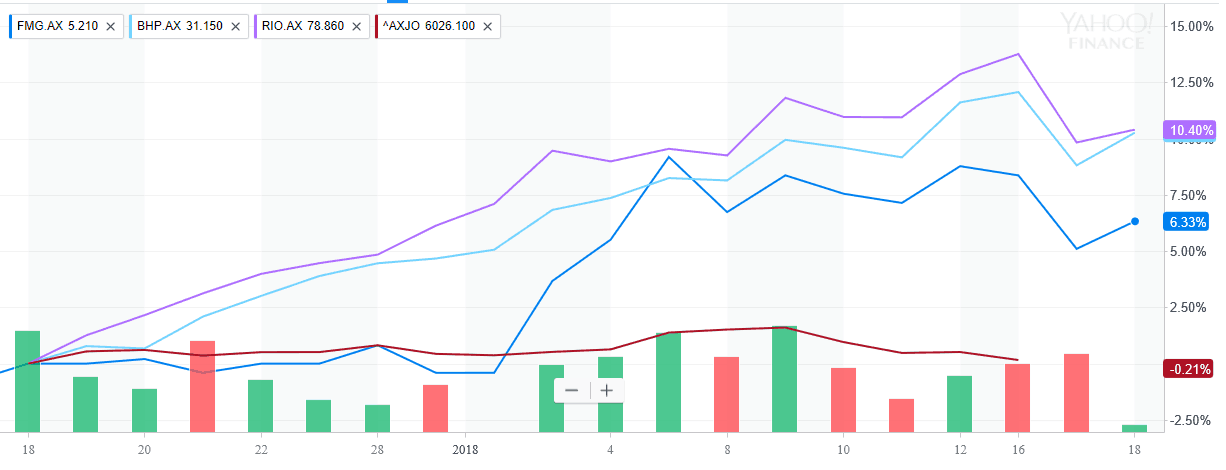

This takes BHP's share price increase to nearly 10.5% in the last month alone as Rio Tinto delivered similar gains and Fortescue improved by almost 7%.

Source: Yahoo Finance

In contrast, the S&P/ASX 200 (Index:^AXJO) (ASX:XJO) can barely keep its head above breakeven over the same period!

But the growth spurt may be coming to an end, at least temporarily. Macquarie Group Ltd (ASX: MQG) is expecting iron ore prices to retreat as China (the largest consumer of the commodity) shuts down for the Chinese New Year break starting on February 16.

The broker notes that the iron ore restocking by Chinese customers has largely been completed although any pullback in prices will be short-lived.

"A pullback in spot iron ore prices during the holiday period may present a buying opportunity for investors in late-February," said the broker.

"While China looks well stocked with raw materials, its steel inventories are still exceptionally low, and we continue to see upside risk for iron ore from a post-CNY push on crude steel production."

This of course assumes that we don't get any "Black Swans" (i.e. unexpected macro shocks) like a material deceleration in China's economic growth, or worse yet, a breakout of hostilities on the Korean Peninsula.

I am expecting BHP and Rio Tinto to keep outrunning the broader market this year, although I am a little more cautious on Fortescue due to its lower grade and more polluting ore.

But resources aren't the only ones well placed to outperform in 2018. The experts at the Motley Fool have uncovered three stocks that they expect to do well in the year ahead.

Click on the free link below to find out what these stocks are.