Media commentators and financial analysts spend a lot of time talking about which way the Australian dollar may head over the 12-24 months ahead in using all sorts of inputs to back up their projections.

It's true that commodity prices and terms of trade can have a marginal impact on the level of the Australian dollar, but the primary driver of the local dollar's level remains cash interest rates offered in comparison to other countries.

Of course interest rate projections are no secret and currencies are largely priced versus future expectations, but it remains that the local dollar could remain under pressure in 2018.

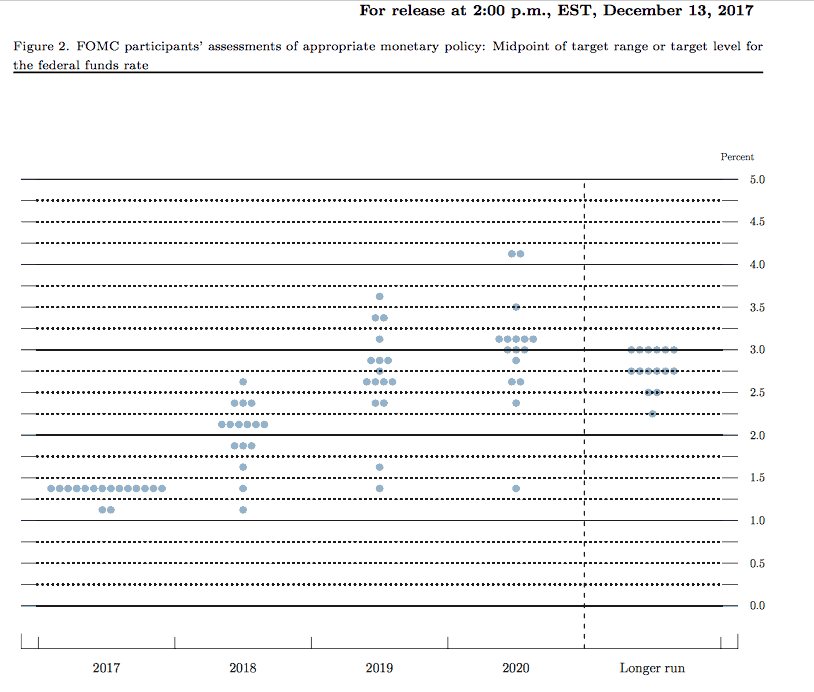

The chart below shows how rate setting members of the U.S. central bank expect rates in the U.S to be between 2%-2.5% by the end of 2018, which means we could be looking at three more 25 basis point hikes above today's level of 1.5%.

In contrast Australian traders are uncertain as to whether the RBA will lift rates at all in 2018, with some not ruling out another cut.

As such by the end of 2018 U.S. interest rates could be significantly above local rates in a result that is likely to keep the local dollar under pressure.

The dots on the US Fed's chart below show how the majority of its members expect U.S. rates around 2.25% this time next year.

Source: US Federal Reserve

Source: US Federal Reserve

If the macro-economic environment does play out to expectations in 2018 then U.S. dollar earners listed on the local exchange could enjoy a strong second half to 2018 if the Aussie dollar were to fall to around U.S. 70 cents.

Businesses like Amcor Limited (ASX: AMC), Macquarie Group Ltd (ASX: MQG), ResMed Inc. (CHESS) (ASX: RMD) and James Hardie Industries plc (ASX: JHX) look worth considering, among others.