The share price of this bank stock is on track to close the year well ahead of its peers and there's a good chance it's not on your radar.

I am referring to CYBG PLC CDI 1:1 (ASX: CYB), or better known as Clydesdale Bank in the UK – the unwanted child of National Australia Bank Ltd. (ASX: NAB).

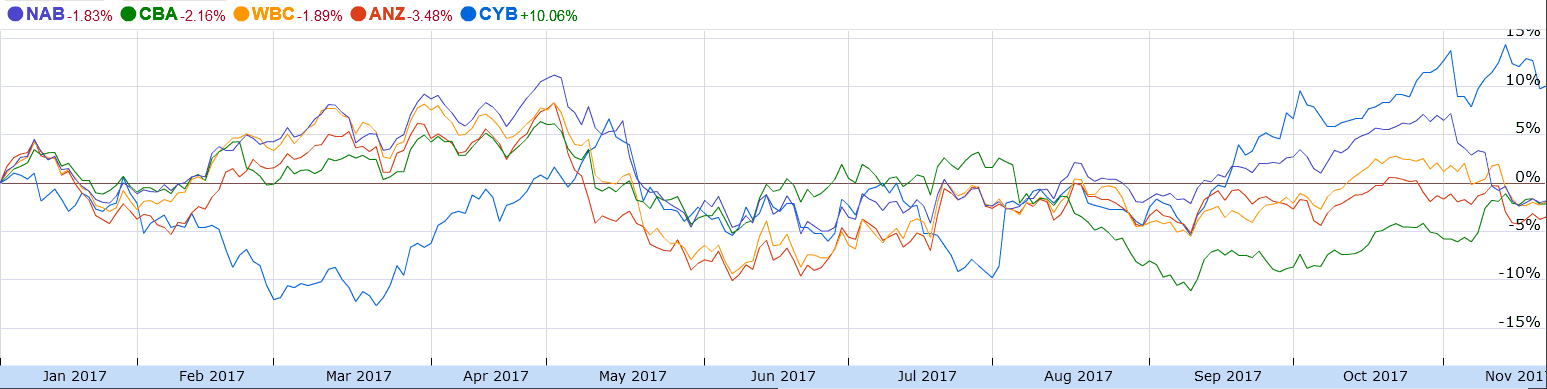

CYBG was spun out of NAB in February last year and shareholders have never looked back. If they did, they would see the Big 4 struggling to keep up with the stock climbing 27.4% over the period and around 10% this calendar year.

In contrast, NAB, Commonwealth Bank of Australia (ASX:CBA), Westpac Banking Corp (ASX: WBC) and Australia and New Zealand Banking Group (ASX: ANZ) are struggling on the wrong side of breakeven this calendar year.

Source: Google Finance

CYBG's outperformance even extends over the regional banks like Bank of Queensland Limited (ASX: BOQ) and Bendigo and Adelaide Bank Ltd (ASX: BEN).

The question now is whether the UK mortgage lender can keep outperforming in 2018 and its latest full year results that were released last night will give believers reason to feel bullish about the next 12 months.

Management reported its first statutory net profit of £182 million ($318 million) in five years and is likely to pay its first dividend on the back of the bank's pleasing performance. The recommended dividend is 1 pence, nothing to get excited about, but the maiden dividend points to a coming of age for the once struggling bank.

What is perhaps more pleasing is that the increase in profit is not due to a lowering in bad debt provisioning, which was a key driver for our local banks reporting higher earnings.

CYBG's earnings growth was due to cost savings with underlying costs falling by 7%. This is more than what management were targeting and that improved its cost-to-income ratio to 67% from 74%.

One downside is margin pressure due to intense competition in the UK market. While CYBG managed to keep net interest margin (NIM) stable at 2.27% for the year ended 30 September 2017, it warned that this is likely to dip to around 2.2% in FY18.

However, 2.2% is still respectable for a challenger bank when compared to the Big Four in Australia.

Further, CYBG doesn't have to worry about the over-indebtedness of Australian households and other potential issues with our hot residential property market. While I do hold modest positions in some of the Big Four, I have been overweight on CYBG and I am happy to keep this bias in place for the year ahead.

On the other hand, those who are looking for a better yielding stocks may want to see what the experts at the Motley Fool have uncovered for you by clicking on the free link below.