Many investors think that the XERO FPO NZX (ASX: XRO) share price looks expensive. I agree, given that the company's market capitalisation (total value of all the shares) of A$4.2 billion is more than 10x its annualised revenues of NZ$416 million.

That means that the company would need to give every cent it earned from sales to shareholders for the next 10-11 years, just for shareholders to get their money back. That's before paying the staff, tax, rent, electricity, advertising, and so on.

So, it's not hard to make a case that Xero is overvalued, and typically a share price of 10x sales is a good rule of thumb that a stock has become expensive.

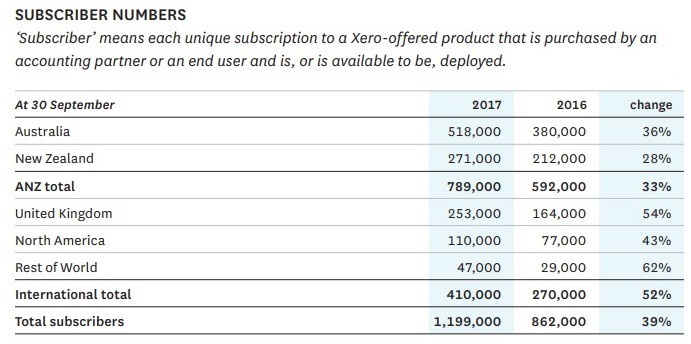

I think Xero is not cheap, but nor is it so outrageously overpriced that it is time to sell, for a couple of simple reasons. First is this chart of subscribers:

There are a few takeaways here. First is that UK subscriber numbers are only half that of Australia, yet they are growing rapidly, and the country's population is 3x ours. That does not mean that sales are going to keep growing, but it does mean that there is a significant runway ahead, and Xero already has a track record of execution.

Second is that simple revenue per subscriber remains quite low at around $30. Although Xero is the most expensive among the competing software companies (Sage, Myob Group Ltd (ASX: MYO), Reckon Limited (ASX: RKN)) – it really doesn't cost users all that much to use Xero software. There is room to either move prices higher.

Additionally, there are a huge number of businesses still using old desktop-based solutions. Many of these may not select Xero for reason of price, but even so the transition to cloud accounting software has a long way to run.

For example, there are just over 2 million small businesses in Australia (19 or less employees, accounts for 97% of all businesses) and 51,000 medium businesses (20-199 employees, accounts for 2.4% of all businesses).

The cost of a $100 Xero subscription per month becomes quickly immaterial (relative to salaries etc) once you get above a few employees, so the most important thing is the value and efficiency that Xero can add, and the company's software is already reputedly the best in the business.

Xero has 518,000 subscribers in Australia. Even excluding really small businesses, Xero appears to have substantial room to continue growing its market share here. I wrote in my coverage of Xero's results yesterday that the company is also growing at a great rate in NZ despite being the dominant provider in that market for several years already.

What's more, Xero spends ~40% of its revenue on software development, and the total dollar figure has been rising rapidly in recent years as revenue increases. There are now over 600 apps available on the Xero platform including functions for timesheets, employee expense management, inventory, bank connections, and more. Customers can get an incredible amount of mileage out of a Xero subscription, and with the current spending on development, I wouldn't be surprised to see Xero develop new products in addition to its core software.

Put it all together, and I think you have a recipe for a company that could generate a huge amount of business value (higher sales and profits) above current levels over the next 10 years. While the price might look expensive, the ingredients for success are all there and I think it would be a big mistake to sell out of Xero today.