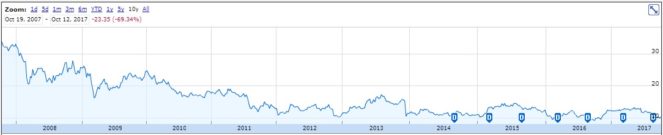

When I first started investing, one of the first companies I bought was QBE Insurance Group Ltd (ASX: QBE) at $22. This was in the throes of the GFC, and I got spooked out of the company a couple of months later – at $24 – for some silly reason I can't remember today. Probably the words 'subprime', or 'crisis', or 'global financial meltdown'.

Still, I can understand why some people say they'd 'rather be lucky than good':

Yet, despite some deeply seated scepticism about this business:

I think QBE is a buy.

There's 3 primary reasons:

- Insurance prices are probably going to rise in 2018.

If you've lived in a cyclone-prone area you will know that insurance pricing always skyrockets after a disaster. It's hard to know how much prices will rise by, but QBE has already purchased its reinsurance program for 2018, meaning it will be able to pocket much of any increase.

This assumes there aren't more disasters next year, of course, and it also assumes QBE is pricing risk appropriately, which is an open question. QBE may also decide it's had enough of lumpy earnings and purchase additional reinsurance, which could reduce the benefit.

- Interest rates are going up

Maybe, anyway. But if and when they do, QBE stands to benefit. As we've seen with Insurance Australia Group Ltd (ASX: IAG) recently, insurer share prices start to rocket well in advance of any rate increase.

- QBE is underpriced relative to peers

Using a superficial price to earnings multiples, QBE looks about 30% cheaper relative to IAG or Suncorp Group Ltd (ASX: SUN). To be sure, this underpricing is justified. However, if you take the view that QBE could have higher than average profitability in 2018 due to insurance prices and the possibility of rising rates, and that these things would cause the market to re-rate the company, then QBE could perform strongly over the next 12 months or so.

I couldn't advocate owning QBE shares for the long term until I see that the company has its house in order. However, I also think there's a pretty good case to be made that QBE shares are around 30% underpriced today.

Take that with a healthy dose of scepticism though. About 50,000 other investors have said the same thing in the last 5 years, and it didn't pan out well.