The Commonwealth Bank of Australia (ASX: CBA) share price has fallen 10% in six months – has it reached a bottom?

Commonwealth Bank of Underperformance

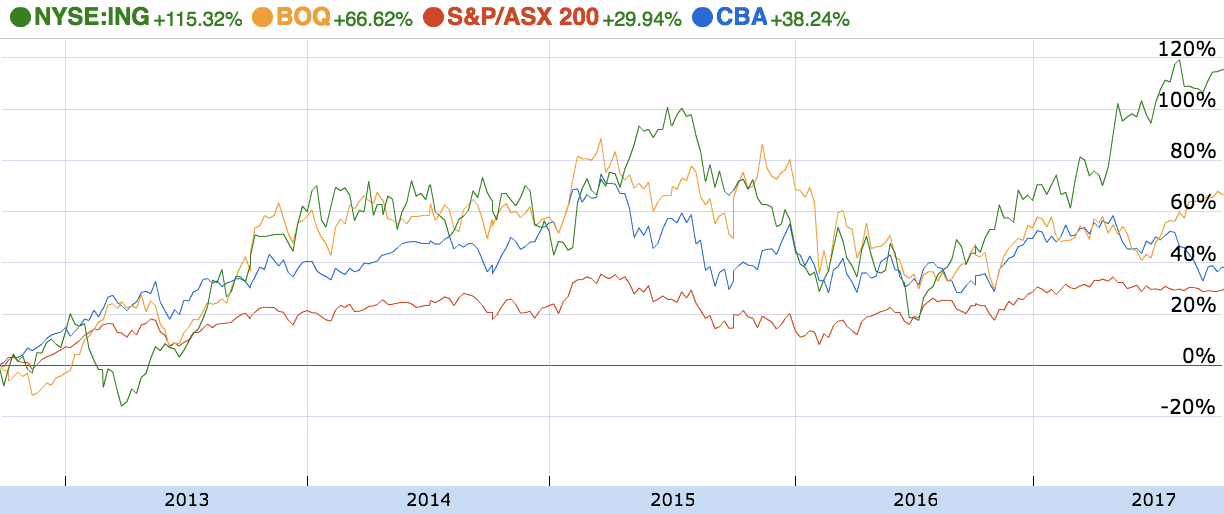

Although CBA has been Australia's best big bank share to own over the past two decades, it has failed to keep pace with some of its peers over the past five years. CBA shares are up 34% while the market, or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO), is up 28%.

However, Bank of Queensland Limited (ASX: BOQ) is up 78% and ING Group NV, the Dutch bank operating in Australia, is up 118%.

Throughout 2017, the picture looks even worse. CBA has underperformed each of its peers and the market by a wide margin.

What's going on?

As the Economic Times reported earlier this week, Australia's biggest bank is preparing to fight allegations over money laundering and a class action brought forward by Maurice Blackburn and IMF Bentham Ltd (ASX: IMF) on behalf of shareholders.

AUSTRAC, the Australian financial intelligence agency, recently issued a report alleging a significant breach of disclosure rules.

Maurice Blackburn believes that just the news of the alleged breaches saw, "one of the biggest single price movements in CBA's recent history."

Its website adds, "the class action alleges that CBA knew about serious instances of non-compliance with the AML/CTF Act and that its failure to disclose that information to the ASX amounts to misleading and deceptive conduct and a breach of its continuous disclosure obligations under the Corporations Act 2001 (Cth) and the ASX Listing Rules."

CBA has around 800,000 shareholders who may have already suffered when the news broke, and from any potential court proceedings.

Is 5.4% just volatility?

As much as I don't like the big banks and the wrongdoings of their advisers and staff, I think class actions can artificially detract from the financial system. Obviously, criminal penalties are different and CBA should front AUSTRAC in the court system for all of the allegations.

But what's interesting is that the class action is for the 5.4% fall in CBA shares! My shares fall 5.4% all the time — volatility is part and parcel of the market system if you ask me.

Foolish Takeaway

CBA shares have been sold down on account of slowing growth, rising interest rates and fears of a big fine from the courts. Personally, I think it's too early to speculate on the magnitude of the outcome.

Instead, as always, make sure your portfolio is well diversified by sector and geography. And if you want to buy bank shares in 2017, consider looking to names outside the Big Four. I know I have.