Catapult Group International Ltd (ASX: CAT) and Gentrack Group Ltd (ASX: GTK) are two completely different businesses but each deserves to be on your watchlist, in my opinion.

Gentrack & Catapult

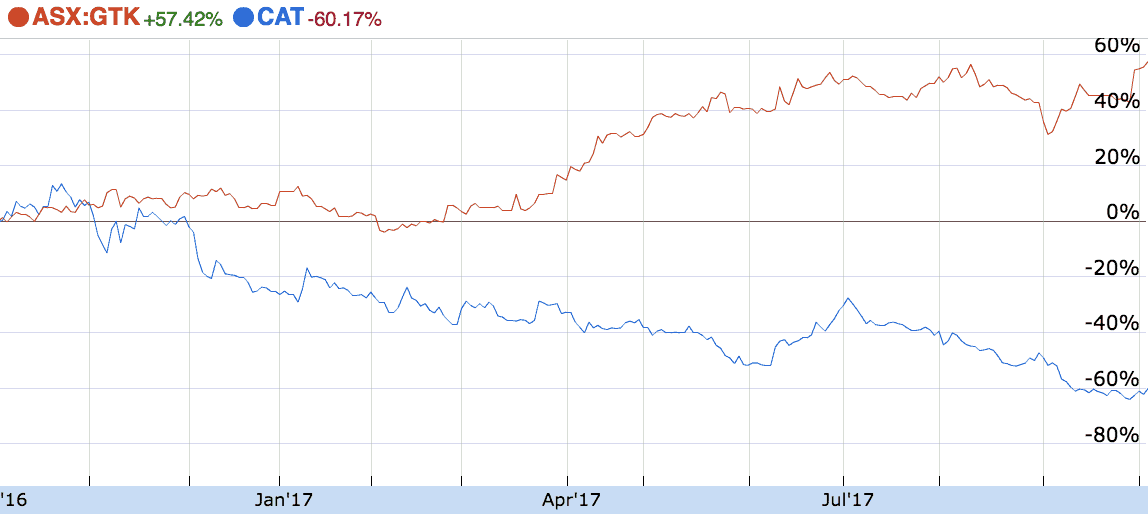

As can be seen above the performance of these two companies has been at odds over the past year. Catapult, for example, has been whacked 60% while Gentrack is 57% higher!

Catapult

Catapult is a $220 million sports technology business. It has created a GPS device which sits in the shirt of professional sportspeople, like NBA and AFL stars.

Catapult has also made acquisitions of complementary businesses enabling it to offer an end-to-end solution for broadcasters and coaching teams.

I think Catapult shares have been sold down because investors are concerned the company is not living up to its growth potential and may need to sell shares to raise more capital.

If you are a current shareholder and your company sells new shares it generally leaves a bad taste in your mouth, especially if you don't get an offer to participate. However, it can be double-whammy if your company raises more capital after its share price has fallen — because it will need to issue more shares.

Nonetheless, I'm much more tempted to buy Catapult shares at today's prices than I was when it was priced at over $3!

Gentrack

Gentrack is a $400 million software business, operating out of New Zealand. The company has continued its profit growth in 2017, recently upping its full-year outlook.

Gentrack's software is integrated into the systems and processes of its clients, which includes utilities providers and airports. That makes its revenue sticky and reliable over time.

Unfortunately, I think Gentrack shares are now a little too expensive to justify a meaningful investment unless you have a very long-term investment horizon.

Foolish Takeaway

Catapult is facing some headaches in the near term but if it can regain its glamour it could go on to be a convincing market beater from today's prices. Gentrack is a great company with an impressive outlook, but it doesn't come cheap.