The Gentrack Group Ltd (ASX: GTK) share price leapt 8% today despite the broader market or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO) ending mostly flat.

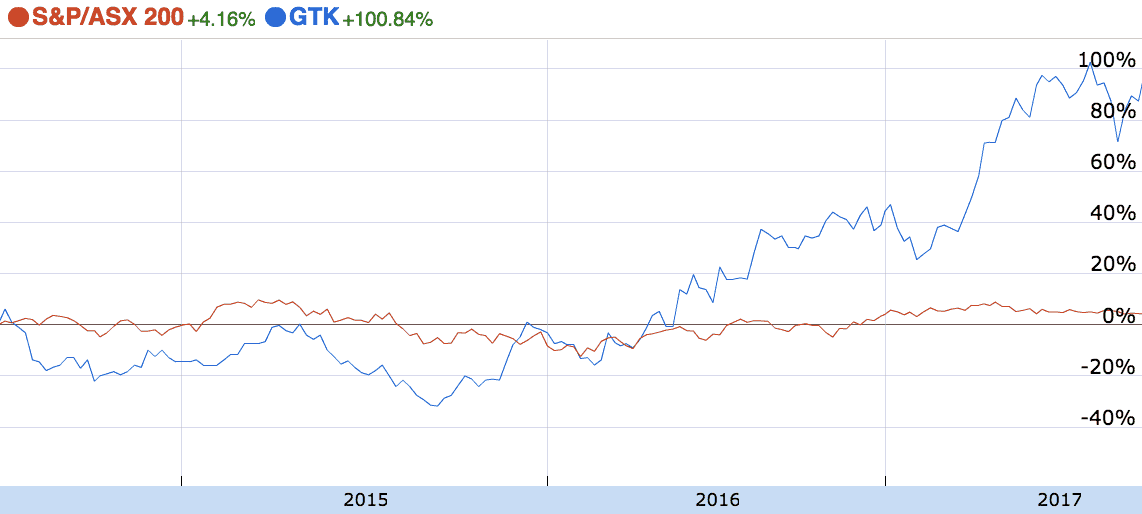

Gentrack V. ASX 200

Not only have Gentrack shares bounced higher today, as can be seen in the chart above the company has been kicking goals for shareholders for a few years now.

What's going on?

Gentrack is a software developer for airports, energy and water utility companies. It has grown organically and by acquisition, pushing into key overseas markets like the UK.

But what specifically caused the pop in Gentrack's share price today was news that the company expects its 2017 operating profit to be NZ$24 million, up from the NZ$20 million guidance it gave in May.

The forecast excludes product development costs and costs associated with its acquisitions undertaken during the year.

Is it a buy?

I have been writing this entire year about why Gentrack was a compelling investment — I just wish I followed my own advice.

There are a few things that make Gentrack's business very attractive for long-term investors. It has loads of recurring revenue thanks to its sticky product lines and deep industry knowledge. It also pays a handy dividend.

Having said that, Gentrack shares no longer come cheap. So while I am tempted to dip my toes into the water with a small position, I am erring on the side of caution and sitting on the sidelines, for now.

(as I have been — regrettably — all year)