Telstra Corporation Ltd (ASX: TLS) shares and TPG Telecom Ltd (ASX: TPM) shares may be offering long-term investors a compelling margin of safety at today's prices.

Telstra shares and TPG shares sink

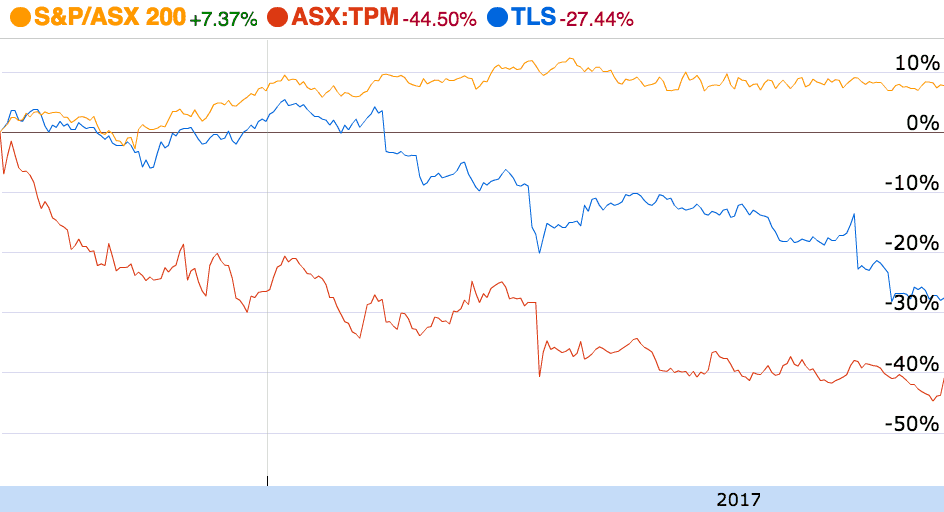

As can be seen above, shares of Telstra and TPG Telecom have plummeted over the past year. Meanwhile, the market, or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO), is up 7%.

This, following years of investor euphoria in which shares of Telstra, TPG Telecom and other telecommunications companies were rallying beyond belief.

But which is the better buy now?

Telstra

Telstra is a legacy leader in local broadband, phone, and mobile markets. However, broadband and home phones are dying markets, thanks in large part to the NBN. Mobiles are Telstra's leading business. But even it is being challenged by TPG, Optus and Vodafone.

Nevertheless, I think Telstra's mobiles business can afford to charge a premium for its services because people want better coverage and a reliable network. That's why I believe the arrival of TPG's 5G network into the mobile market is more likely to impact Optus and Vodafone.

TPG

As noted TPG is attempting to roll out a 5G mobile network in high-density areas, which should be available by 2020. It is also expanding in the Singaporean mobiles market. Both of these strategies are a positive for long-term focused TPG shareholders, in my opinion. However, in the near term, the disruption caused by the NBN is taking its toll on TPG's business.

That's why its shares appear very cheap.

Foolish Takeaway

Obviously, the best time to buy shares is when they are undervalued. But you are far more likely to find undervalued shares where other investors are not looking.

I haven't pulled the trigger on Telstra or TPG Telecom shares just yet, but at these prices both companies appear quite compelling and worthy of further research.