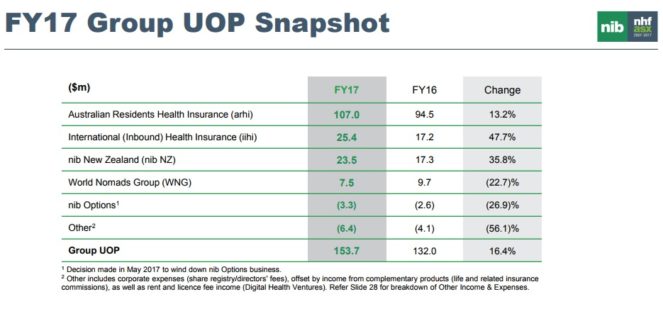

The NIB Holdings Limited (ASX: NHF) share price fell 6% to $5.67 this morning after the company released its full-year results. Revenue rose 7% to $2,004 million, net profit after tax (NPAT) rose 31% to $120 million, and underlying operating profit (UOP) – management's preferred measure of ongoing profitability – rose 16% to $154 million.

Company growth was strong in the major categories, with Australian residents, international inbound, and NIB New Zealand all reporting solid growth.

Growth in market share accounted for the majority of Australian Residents earnings growth, while a decision to exit unprofitable business boosted international inbound results. Across the board, moderate claim expenses combined with revenue growth were the key to NIB's improved performance, and the company also netted a further $29 million from bumper investment results. Company gearing (debt) declined marginally despite a big increase in dividends to 19 cents per share, up from 14.75 cents in 2016.

In addition to new products and opportunities in Australia and New Zealand, NIB management has also flagged a small expansion into China, with the possibility of a joint venture into insurance broking for 'critical illness' lump sum insurance products. These products pay a defined sum on the diagnosis of a pre-defined range of conditions. The investment is only small, with an expected cost of $12 million over the next 5 years, and does not carry underwriting risk. This means that NIB would just be selling the policies, not carrying the responsibility for paying claims. This seems a low-risk way to expand and could be an interesting prospect if it goes ahead.

In its ANZ markets, NIB said the outlook was for weak growth and margin pressures due to claims inflation and pricing. On the plus side, they feel that the impact of government policy is generally neutral and there may be potential for further industry consolidation. The international healthcare and travel insurance markets have brighter outlooks, with strong growth and the potential for international expansion as mentioned above. Management is targeting organic growth in its Australian business of 4% to 5% per annum.

NIB is a great business but in my opinion it was priced a little richly heading into today's results. Still, I consider it to have a much greater opportunity than Medibank Private Ltd (ASX: MPL) and would definitely prefer to own NIB over it.