Reaching your 50s with little or no savings can feel unnerving.

Retirement may be on the horizon, yet financial independence still seems far away. But it is not too late, not by a long shot.

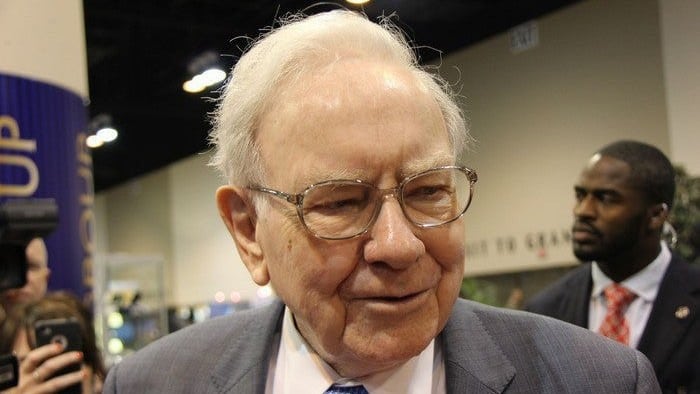

If there's one investor who has shown that time, consistency, and discipline matter more than luck, it is Warren Buffett. And while most of us don't have his billions (or his patience), the principles that made him one of the richest people on earth are surprisingly simple.

Here's how I would apply Buffett's methods to start building serious wealth, even from scratch at age 50.

Focus on what you can control

Warren Buffett once said: "We don't have to be smarter than the rest; we have to be more disciplined than the rest."

This means ignoring short-term market noise and focusing on the habits that actually build wealth. These are spending less than you earn, investing regularly, and staying the course.

Even if you're starting with nothing, contributing $1,000 a month into a diversified mix of ASX shares or exchange traded funds (ETFs) could build you a very attractive nest egg.

For example, if you could earn an average 10% annual return (achievable but not guaranteed) from a balance portfolio, you would have around $200,000 in 10 years.

Keep going for a total of 15 years and that becomes roughly $400,000.

The earlier you start, the better, but the principle is the same: steady investing beats inconsistent investing every time.

Invest in quality

Buffett's fortune didn't come from day trading. It came from buying great businesses and letting compounding do the work.

That's as true for Australian investors as it is for those in Omaha. Think of ASX 200 blue chip shares and growth leaders such as CSL Ltd (ASX: CSL), WiseTech Global Ltd (ASX: WTC), or Coles Group Ltd (ASX: COL). These are companies with durable competitive advantages and strong earnings visibility.

Alternatively, ETFs like the iShares S&P 500 ETF (ASX: IVV) or the Vanguard Australian Shares ETF (ASX: VAS) provide instant diversification across hundreds of leading businesses.

The key is to buy quality, reinvest dividends, and give compounding time to work its magic.

Warren Buffet thinks like an owner

Buffett always stresses the importance of owning businesses, not just buying stocks. That means investing in companies you understand and believe will still be successful a decade from now.

If you wouldn't feel comfortable owning a business through a downturn, you probably shouldn't own its shares at all. Focus on ASX shares with strong cash flows, good management, and products that people will still need regardless of economic conditions.

That mindset shift, from trading to ownership, is one of the most powerful changes any investor can make.

Foolish takeaway

Warren Buffett built the vast majority of his fortune after age 50. Compounding accelerates as your investment base grows, which means the most significant gains often come later.

The biggest mistake new investors make is giving up too early. But as Buffett himself puts it: "The stock market is a device for transferring money from the impatient to the patient.'

Stay patient, stay invested, and keep contributing. Because even if you're starting at 50, the next 20 years can still be some of your best.