This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The new year can be a time to reevaluate your portfolio. Did you buy too many high-risk stocks that did poorly in 2024? Now is the perfect time to switch things up and build a durable portfolio that can sustain and grow your wealth over the long haul.

Many of us wait for the new year to invest more money into our retirement accounts. Maybe you had a nice bonus at the end of 2024 that you want to tuck away as savings. If you have $10,000 ready to invest in 2025, there are plenty of cheap-looking stocks you can buy and hold for the long haul.

Here are three stocks legendary investor Warren Buffett owns at Berkshire Hathaway to buy in 2025.

1. American Express: A durable credit card giant

One of Buffett's largest and longest-held positions is American Express. The credit card giant has been a fantastic long-term performer, especially since Buffett started buying it in 1991. With its vertically integrated payments network, American Express has a competitive position over other credit card companies. And with big travel perks like travel lounges, hotel deals, and cash-back savings with partners such as Uber, American Express has an enviable position with wealthy clients around the world.

This value proposition is why American Express should durably grow over the long haul, and why Buffett has never sold a share since initially buying the stock. The brand continues to add new credit cards to its network — 3 million added last quarter alone — which will drive more spending and profits over the long term.

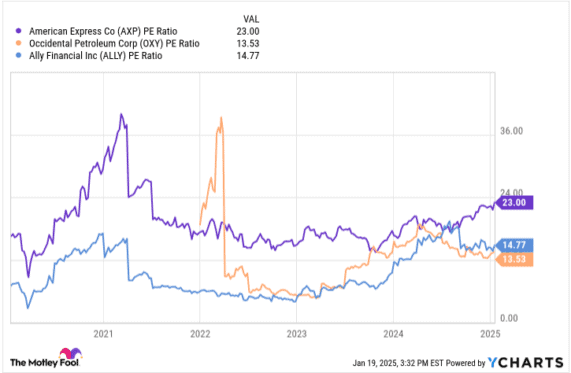

Management sees revenue growing 10% annually and earnings per share (EPS) growing even faster. Today, the stock trades at a price-to-earnings ratio (P/E) of 23. That's slightly above the company's long-term average, but is still attractive for a business that plans to grow EPS at the mid-teens level annually. Buy some American Express stock for your portfolio in 2025 and sit tight with the position.

2. Occidental Petroleum: US fossil fuel production

The world still consumes oil and natural gas. Fossil fuels have been a big part of our energy picture and will be for decades. Even places like Norway — which has rapidly adopted electric vehicles — still consume similar levels of oil compared to a few decades ago.

The United States is far behind in electric vehicle adoption and is in a transition of rapid industrial build-out due to the government's reshoring policy. One big beneficiary of these trends should be Occidental Petroleum, one of the largest oil and natural gas producers in the United States. Last quarter, the company was producing 1.4 million barrels of oil (or natural gas equivalent) per day, which was a record. Even with oil prices well below highs set a few years ago, Occidental Petroleum generated $1.5 billion in free cash flow last quarter.

Over the last 12 months, Occidental Petroleum has generated $4.5 billion in free cash flow. This looks rather cheap versus a market cap of $49 billion, and likely why Buffett has piled into the stock. Unless oil prices crash, this stock will do well over the long term and can be a permanent energy hedge for your portfolio in 2025 and beyond.

AXP PE Ratio data by YCharts

3. Ally Financial: Banking for the 21st century

The last stock on my list is a lot smaller than Occidental Petroleum and American Express, making it a smaller position in the Berkshire Hathaway portfolio. Still, the conglomerate is the company's largest shareholder and owns around 10% of its common stock. Enter Ally Financial, one of the largest digital banks in the world.

Spun out from General Motors during the financial crisis, the automotive lending giant turned itself into an online-only consumer bank, with over $100 billion in deposits. Customers have flocked to the bank because of the high interest rates it pays on deposits, something legacy banks can't match with higher overhead costs.

Investors are tepid about Ally Financial because of rising loss rates in the automotive sector and the headwinds presented by rising interest rates on its loan book. With the Federal Reserve lowering interest rates and the automotive sector stabilising, I think Ally Financial can get back on the right footing in 2025. Buffett and his team likely agree, which is why they haven't sold a single share during this downturn.

As of this writing, Ally Financial has a P/E of around 15 based on a net income figure that is well off of its all-time high. As earnings recover in 2025 and 2026, Ally's P/E should shrink to dirt-cheap levels, which will likely lead to a rising stock price, rising dividend payouts, and share repurchases. This formula should make investors who buy and hold Ally stock quite happy over the long haul.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.