The Santos Ltd (ASX: STO) share price edged higher on Tuesday.

Shares in the S&P/ASX 200 Index (ASX: XJO) energy stock closed yesterday trading for $7.14 apiece, up 0.28%.

That's a little shy of the 0.48% gains posted by the ASX 200.

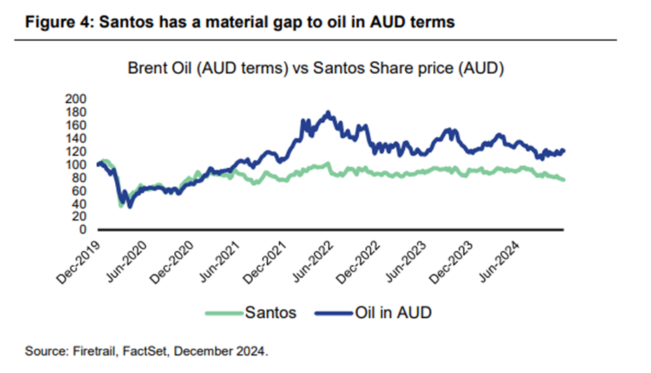

As you can see on the chart above, the Santos share price went backwards in 2024, ending the calendar year down 12.1%. Though that's not including the 46 cents per share in dividends the oil and gas company paid out over the year. At yesterday's closing price, Santos trades on a 6.4% unfranked trailing dividend yield.

You can also see that Santos stock took a positive turn commencing on 19 December, now up 12.3% since then. This coincides with a sizeable lift in the oil price. Since 19 December, Brent crude oil has gained 10.7%, trading for US$80.71 per barrel at market close yesterday.

And, as the analysts at Firetrail point out, with the relative strength of the US dollar, oil in Aussie dollars has been making even bigger gains.

Santos share price outperforms for Firetrail in December

In Firetrail's December High Conviction Fund update, the investment manager noted it is overweight on "cyclical companies exposed to commodities where supply is constrained in the medium term, such as Santos".

And with the upswing in the Santos share price in the latter weeks of December, the ASX 200 energy stock closed the month in the green.

"Santos shares outperformed the market as oil prices stabilised. During the month, Santos announced a 12-year gas supply agreement with a Japanese customer," Firetrail said.

Taking a step back, Firetrail said:

Santos underperformed the market over the year. The underperformance was in line with most global energy stocks, but slightly surprising given the rise in crude oil prices in Australian dollars (note: oil fell 5% in USD terms).

And Firetrail remains optimistic on the outlook for the Santos share price, with the company's growth projects scheduled to come online in 2025 and 2026.

According to Firetrail:

Good progress was made on the two key growth projects at Barossa (offshore Australia, 84% complete) and Pikka (Alaska, 70% complete). The delivery of both projects throughout 2025 and 2026 will see production increase by 30% and cashflow by even more.

Capex was revised up at the Pikka project during the year driven by accelerated pipelay activities and broader inflation.

Santos has also been doing more than simply paying lip service to its ESG commitments.

"Santos successfully delivered the 1.7 million tonnes per annum [at the] Moomba Carbon Capture and Storage plant in the middle of Australia, providing support for their net zero 2040 target," Firetrail noted.

Looking ahead

Looking ahead, Firetrail remains bullish on the outlook for Santos shares.

Its analysts pointed to the following chart, showing "the large gap that has opened between the cashflow driver [oil priced in Aussie dollars] and the share price since 2021".

"You can cut it many ways, but Santos continues to look undervalued to us," Firetrail concluded.