This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Financial professionals like to talk of "psychologically important" price levels for securities. Although this fancy-sounding term is more construct than reality, when an asset hits or exceeds a certain price, it can dramatically boost confidence in its future.

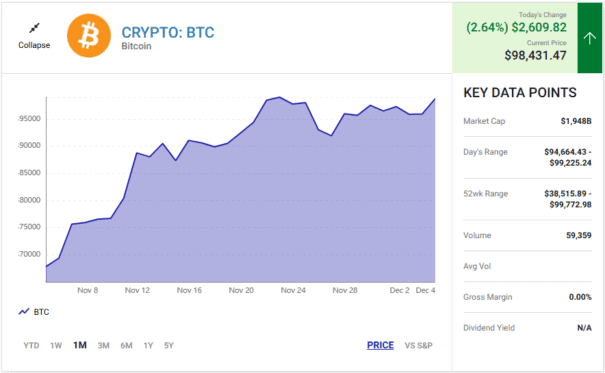

These days, all eyes in the crypto world are on the trajectory of Bitcoin (CRYPTO: BTC). During the past few weeks, it has approached the $100,000 level, at times getting tantalisingly close to that mark. As of this writing -- December 4 -- it's trading at about $98,000. Here's my take on whether we'll hit this magic number at some point during the next 24 hours.

A year full of catalysts

Before we discuss that, let's do a little tour of recent Bitcoin history. If we cast our imaginations back to the long-ago, dark days of December 2023, Bitcoin was sailing along at about the low $40,000s. Within weeks, though, the first of several powerful catalysts propelled the coin's trajectory upward.

This was the approval, after much lobbying from both institutional and individual market players, of spot Bitcoin exchange-traded funds (ETFs) in January 2024. Bitcoin funds existed before this, of course, but these new instruments were an innovation because they were actually allowed to hold the crypto directly.

This meant that, for the first time, investors could essentially put their money more or less straight into Bitcoin without owning any of the physical crypto. That's a true advantage because ETFs trade publicly and can be bought and sold as easily as stocks. That's not really true of digital currencies like Bitcoin, Ethereum, or Dogecoin -- these require some tech know-how and the willingness and capacity to maintain digital wallets.

The spot Bitcoin ETFs were the rocket fuel propelling their foundational cryptocurrency upward. No rally lasts forever, but as the ETF-fueled one faded, the macroeconomic picture got brighter. In September, encouraged by notable declines in the rate of inflation, the U.S. Federal Reserve made the first cut to its key interest rate since early 2020. This was followed by a more modest reduction in November.

Lower interest rates are good for cryptocurrencies because they theoretically encourage investors to take on more risk. Although it's something of a blue chip equivalent in the digital currency realm, Bitcoin is considered relatively risky simply because it's a crypto.

Finally, the victory of Donald Trump in the presidential election gave Bitcoin and its ilk even more of a push. Trump and his Bitcoin-owning Vice President-elect J.D. Vance have both expressed support for the crypto industry. Their ascension was quite a relief to believers in an asset class that has been maligned at times by both lawmakers and regulators.

Patience is a virtue

With those kinds of forces supporting its growth, it's understandable that Bitcoin more than doubled in price during that relatively limited period of time. So let's gaze into the crystal ball. Will today also be Bitcoin $100,000 day?

If I were a betting man, I'd put my money on "no." I feel that a key reason the price has been hovering lately is the lack of a fresh catalyst or two. The election is one month in our past, spot Bitcoin ETFs are well-established at this point, and the Fed might not be in a hurry to cut rates again (besides, the next meeting of its Federal Open Market Committee is set for late January).

It's possible we won't even get that price as a nice gift in time for the holidays. Rather, I'd imagine that -- barring any negative developments affecting cryptos -- the famous January Effect will push Bitcoin above $100,000 at the start of 2025. Investors are typically more optimistic that month, and many will be adjusting their portfolios. More than a few will cast a longing gaze toward the leading digital coin's price graph.

Hopefully for the Bitcoin holders out there, I'm wrong, and we will witness a historic day in a matter of hours. But, hey, no one can complain about the gains we've already had.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.