When you think of Aussie data centre titans, NextDC Ltd (ASX: NXT) springs to mind. However, a new kid is stepping onto the digital block. Today, an ASX 200 stock is parading the latest in a string of deals to bring a data centre real estate investment trust to the boards of the ASX.

HMC Capital Ltd (ASX: HMC) is putting its deep pockets to work. After raising $300 million at the tail end of October, the fund manager is showing and telling today where all those dollars have flowed. The latest acquisition will form part of the upcoming Global Digital Infrastructure Platform (DigiCo).

Let's walk the halls of this data centre deal.

ASX 200 stock lands another one

The team behind the genius strategy to convert struggling Masters properties into higher-value multi-tenant retail spaces is busy executing a new plan. This time, HMC Capital — formerly Home Consortium — is wrapping up a bunch of data centres into a single investable product.

As per the release, HMC Capital has entered into an agreement to acquire iseek — a co-location data centre platform flaunting 6 megawatts of installed capacity. The company operates across seven facilities in Queensland, South Australia, and New South Wales.

Furthermore, iseek's capability is utilised by more than 500 customers, including government, enterprise, and hyperscale tenants.

According to HMC Capital, iseek has been acquired for $400 million, 19 times the target company's forecast 2025 operating earnings. Initially, $150 million will be paid upfront, with the remaining $250 million to take the form of a scrip offer in HMC's DigiCo REIT initial public offering (IPO).

iseek will complement the fund manager's earlier data infrastructure acquisition, Global Switch Australia. The portfolio now includes 13 data centre properties, which matches the number of locations commanded by NextDC.

Why data centres?

There are several reasons why the ASX 200 stock is taking a data warehouse to market. A few strong points are highlighted in today's presentation, including:

- Stable income profile

- Diversified customer base

- Strong structural megatrend from data creation and artificial intelligence

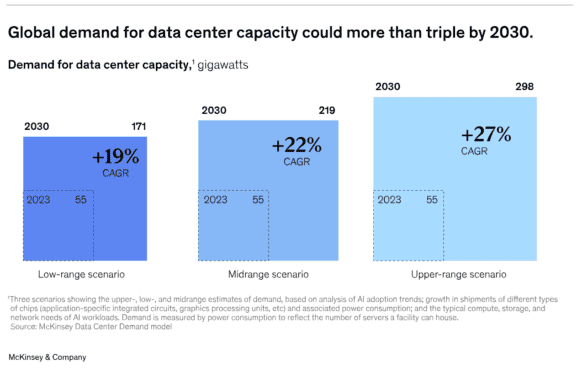

According to management consulting firm McKinsey, around 70% of new data demand is for 'advanced-AI-workloads'. Hence, McKinsey thinks global data centre demand could realistically grow somewhere between 19% and 22% between 2023 and 2030, as shown below.

HMC Capital is aiming to achieve a 4% distribution yield on its DigiCo REIT. Moreover, management believes there is a large opportunity for earnings growth through increasing utilisation. About 28% of the installed capacity is unallocated to customers.

The DigiCo REIT is yet to hit the ASX. However, HMC Capital — an ASX 200 stock — is up a sensational 131% over the past year.